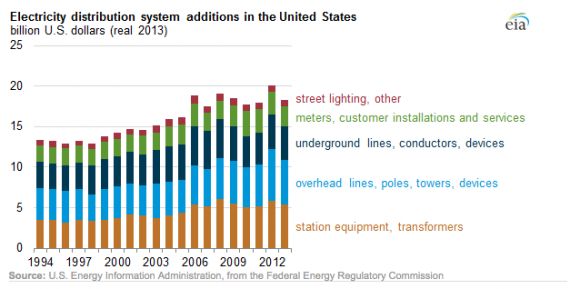

Investor-owned utilities in the United States have made increased investments in the electricity distribution system over the past two decades, according to data compiled by the U.S. Energy Information Administration. Investments are down from a peak of $20 billion in 2012, but 2013 levels are still higher than spending in the 1990s and early 2000s.

The rise in investments comes despite stagnating electricity load growth. According to the EIA, electricity sales declined in four of the five years between 2008 and 2012.

Utilities will need not only to invest more in the distribution system in the coming years as it continues to age and get hit by increasingly severe storms, but also to accommodate a growing amount of distributed generation.

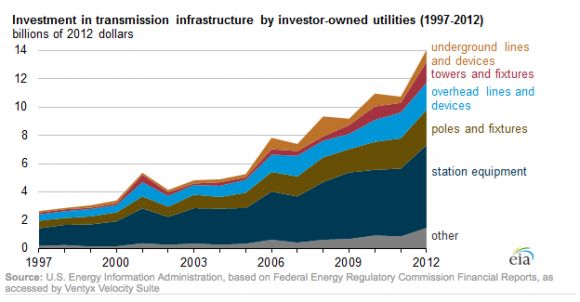

After a lull of several decades, utility spending on transmission systems has also recently increased. A separate EIA report found that investments by investor-owned utilities increased fivefold over the last fifteen years. But more is likely needed, as 70 percent of the grid's transmission lines and power transformers are more than 25 years old and the average power plant is more than 30 years old.

Overall, America is woefully behind in making necessary maintenance and upgrades across its infrastructure systems. In its most recent report card, the American Society of Civil Engineers estimates there's a $94 billion investment gap for both the distribution system and transmission system.

Reliability concerns have been a key driver of new spending. Since 1980, the U.S. has sustained 144 weather-related disasters, with total damage costs exceeding $1 trillion, according to the U.S. Department of Commerce. Seven of the ten costliest storms in U.S. history took place between 2004 and 2012.

Superstorm Sandy, the second-costliest cyclone to hit the U.S. since 1990, knocked out power to 8.5 million customers and caused an estimated $65 billion in damages. Greentech Media explored how the storm is prompting utilities to invest differently in a recently released e-book.

The majority of the spending on distribution in recent years has been targeted at hardening the system against weather-related outages. This includes investments in burying vital power lines, installing smart-grid technologies to stop outages from spreading, and replacing or improving the design of vulnerable equipment, such as elevating substations in flood-prone areas.

But it’s not all about protecting the system. Smart grid technologies like advanced meters are also being adopted to allow customers to participate in demand response. And advanced voltage-regulating components are being used to allow communities to have their own solar arrays and other types of distributed generation.

With load growth increasing at a very slow pace, utilities have an opportunity to shift their capital spending from new generation toward investments in modernizing the distribution system to allow for more distributed generation, electric vehicles and other assets.

Edison International president and CEO Ted Craver said at a PJM event this week that Southern California Edison is focusing on investments in the distribution system.

“I think one of the key ways to really help [California] achieve its greenhouse gas policies is to invest in the distribution system so it’s capable of absorbing more in the way of distributed energy resources,” said Craver. “Not just rooftop solar, but also storage and energy efficiency and demand response programs.”