Almost a year after Greentech Media announced the news, based on the accounts of numerous sources, Hanergy has finally admitted that the Chinese energy concern has acquired VC-funded thin-film solar aspirant Alta Devices.

China's Hanergy acquired gallium-arsenide (GaAs) solar developer Alta Devices, as we reported, for an undisclosed amount.

Alta Devices joins Solibro, MiaSolé, and Global Solar Energy (all CIGS thin film) under the Hanergy roof. The full extent of the Hanergy solar strategy has not been articulated publicly by Hanergy or Alta. We suspect that the strategy may not have been articulated privately, either.

Alta CEO Chris Norris has not been able to comment about the deal for the last nine months. I've asked Norris and Hanergy for information on customers, costs and strategy.

Alta Devices has set records for PV efficiency and has raised more than $120 million from investors including KPCB, NEA, August Capital, Crosslink Capital, DAG Ventures, NEA, Presidio Ventures, Technology Partners, Dow Chemical, Aimco, Good Energies, Energy Technology Ventures, and Constellation Energy.

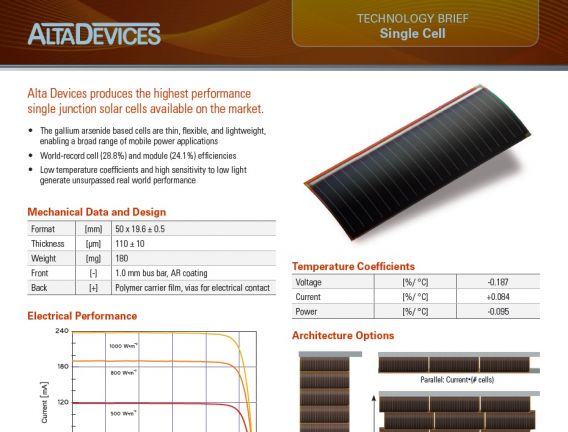

Alta made technical strides in flexible gallium-arsenide photovoltaics, setting records for the materials system and boasting NREL-verified 28.8 percent cell efficiencies for a single-junction solar cell and 30.8 percent for a dual-junction cell. (The theoretical maximum solar cell efficiency limit for a single-junction device, known as the Shockley-Queisser limit, is 33.5 percent. SunPower's crystalline silicon Gen 3 cells have efficiencies in excess of 23 percent.)

But even having the best investors in the world and the best cell efficiency in the world will not get a firm to market if the costs are too high or if parts can't be built consistently at scale, as has been rumored about Alta. We've heard cell cost rumors of $12 per watt, which is an order of magnitude higher than the market cost of solar.

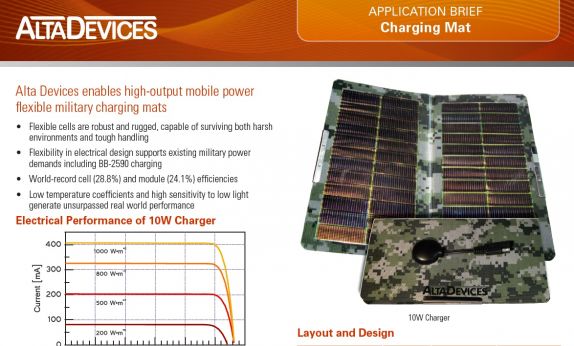

In what we called "a tell," Alta Devices made the announcement that it was moving into solar charging and military applications. Along with building-integrated PV, those tend to be the applications of last resort for less-than-successful solar firms. More recently, the firm has been talking about powering the "internet of things." Yes, efficiency is crucial and price-per-watt is much less important in these sectors -- but cost is still king.

Alta Devices uses an epitaxial lift-off (ELO) technique pioneered by Eli Yablonovitch that produces flexible layers of GaAs that are 1 micron thick. Substrate re-use and cost are issues in this type of technology, as has been the case for both Crystal Solar and Solexel. Alta still has to scale and scrub away cost in the face of technical and economic challenges with ELO and the firm's novel metal organic chemical vapor deposition (MOCVD) processes.

In 2012, Alta CEO Norris spoke of a 10-watt iPad cover in the MIT Technology Review, which reported that Alta had "started selling solar panels to the military to power small unmanned aerial vehicles, and by the end of next year it plans to start selling an iPad cover powerful enough to make plugging in unnecessary." CIGS thin film aspirant Ascent Solar has also targeted its investors' millions toward the portable solar device market, such as it is.

In an earlier interview, the Alta CEO said, "We have about 2 megawatts of capacity in place in our pilot line located in Sunnyvale."

It doesn't appear as if Hanergy has rooftop aspirations for the technology. Hanergy CEO Li Hejun said in a release, "Alta Devices' thin-film solar technology allows more energy to be produced in lower light conditions than any other type of solar cell, giving it greater potential to power a wide range of mobile devices and equipment from phones to cars."

The following figure provides some information about the firm's GaAs solar cell.