When Sinovel, the world's leading wind manufacturer and AMSC’s dominant customer, refused a March 2011 contracted order, AMSC’s business collapsed. Following a year of downsizing and restructuring, AMSC continues to fight for its financial life.

In June 2011, AMSC discovered proof that Dejan Karabasevic, an employee of AMSC Austrian subsidiary Windtec, was promised $1.5 million by Sinovel for proprietary AMSC wind turbine control system code. Investigations turned up evidence of senior Sinovel people requesting the code, the code transfer, and the subsequent use of AMSC’s code in Sinovel turbines. Karabasevic pled guilty to collusion on intellectual property (IP) theft and was incarcerated.

AMSC filed civil lawsuits and an arbitration case in China. It is requesting $1.2 billion in penalties and damages. It also turned over criminal evidence to Beijing law enforcement.

These cases, AMSC President and CEO Dan McGahn said, “will serve as a litmus test for China’s handling of intellectual property cases.” McGahn believes AMSC will prevail. Early indications are not encouraging.

The arbitration case was postponed when, reportedly, there was a death in the family of one of the Chinese arbitrator’s. An observer confided to GTM they do not suspect delaying tactics. But time is on Sinovel’s side.

Though Ireland’s Mainstream Renewables did postpone a billion-dollar deal, Sinovel continues to profit from the use of the turbine control system code to conform to China’s recently upgraded grid standards.

In December, Sinovel filed a dismissal request on the smallest civil case, a copyright infringement complaint seeking a cease-and-desist order and $200,000 in damages. The court just granted Sinovel’s motion and dismissed the case.

“We are starting to see motion from the Chinese courts,” McGahn responded. The decision was “not altogether unexpected, and we are appealing the ruling.”

McGahn, AMSC and its subsidiaries are bringing this attitude to their efforts to resuscitate their power electronics and wind turbine and grid control systems businesses.

“We design wind turbines from the ground up for wind turbine manufacturers,” McGahn said, for “both onshore and offshore platforms, ranging from 2 megawatts to 10 megawatts.” He added that the firm offers “a highly integrated set of electronics and controls” which are “in essence, the brain of the wind turbine.”

AMSC also designs D-VAR, which facilitates transmission system management.

Total 3Q 2011 revenues, McGahn reported, were $18.1 million. The firm's 3Q 2010 revenues were $31.6 million, and 2Q 2011 revenues were $20.8 million. The year-over-year drop was due to reduced transmission system shipments. The quarter-over-quarter drop was from reduced turbine control system shipments.

AMSC had a 3Q 2011 net loss of $26.3 million ($0.52 per share), much of it due to litigation and restructuring. The good news is that the 3Q 2010 net loss was $18.2 million ($0.38 per share) and the 2Q 2011 net loss was $51.7 million ($1.02 per share), so the hemorrhaging may be under control.

“I am pleased to report that AMSC exceeded each of its financial targets for the third fiscal quarter,” was McGahn’s take.

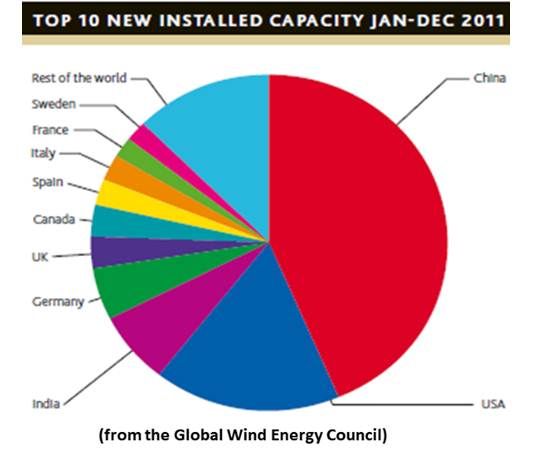

In the wake of the Sinovel scandal, AMSC has vigorously worked to rehabilitate its customer base and build “a diversified revenue stream.” In Q3, McGahn said, there were revenue “contributions from both our wind and grid segments,” with “Australia, India, Korea and the United States each contributing more than 10 percent.”

AMSC’s biggest 3Q 2011 customers, reported Senior Vice President and CFO David Henry, were wind makers Inox (India, 27 percent of revenue) and Doosan (Korea, 12 percent).

AMSC’s wind business, McGahn said, “continues to fare well, relative to the industry, for two primary reasons: our unique business model and our strong presence in Asia.”

The company has D-VAR customers in the U.S., Canada, the U.K. and Australia, McGahn added, and is attracting interest throughout Europe.

McGahn said the company has a “pipeline of business” and expects “sequential growth” going forward. AMSC projects revenues exceeding $27 million and a net loss of “less than $24 million” ($0.47 per share) in 4Q 2011 (ending next month).

Projections that it would finish Q3 “with more than $75 million in cash, cash equivalents, marketable securities and restricted cash,” McGahn noted, were “exactly as we anticipated.”

Henry said the company had $108 million at the end of 2Q 2011 and expects to have approximately $50 million at end of the current quarter. We have, Henry added, “ample cash to get through the next 12 months to fund our operations and capital requirements.”

AMSC’s next court date is February 24 with the Beijing Arbitration Commission. McGahn is optimistic.

But optimism may be inadequate in the confrontation with China’s legal system. Both a Shanghai corporate head and an attorney who does business law in China offered GTM the same potentially crucial insight.

In the Chinese legal system, the weakness in AMSC’s case is that it did not have a contract specifying what damages it would be entitled to.

From the Chinese point of view, the Shanghai corporate head said, it was “not unforeseeable” that there would be an intellectual property conflict. Chinese courts will not necessarily look sympathetically on AMSC’s failure to contractually protect itself. The Chinese courts may agree with AMSC on the facts, the attorney concurred, but in the absence of a contract spelling out damages, AMSC cannot expect to “be made whole" in the final decision.

That's the grim reality.