California is in the midst of transforming its utility and power grid regulations, with an aim of incorporating distributed energy resources like rooftop solar, behind-the-meter batteries, plug-in electric vehicles, and flexible demand-side resources into the state’s energy mix by the end of this decade. It’s a multifaceted transformation, with many moving parts -- net metering 2.0 regulations, a gigawatt-scale energy storage mandate, utility-scale distributed energy procurements, self-generation incentives, demand-response auctions, and long-range time-of-use and distributed energy tariff structures, to name a few. But two key regulatory efforts at the California Public Utilities Commission are leading the charge.

The first, CPUC’s distribution resources plan (DRP) proceeding, has been underway since last year. It orders the state’s big three investor-owned utilities to find the value of DERs in their future multibillion-dollar distribution grid upgrade and upkeep plans and start to define how they could stand in for traditional investments in things like wires, poles and transformers in the years ahead. Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric submitted their DRP proposals in June, along with a list of pilot projects they've suggested to meet the proceeding's requirements.

The second, CPUC’s integration of distributed energy resources (IDER), was created in August, and sets a broad mandate to reorganize how the state manages every aspect of planning -- and paying for -- the integration of utility and third-party DERs. That includes “the development of an end-to-end framework for integrating demand-side resources, including relevant valuation methodologies and sourcing mechanisms” -- in other words, the rules for utilities to go out and get the distributed energy resources they’ve identified a need for, through the aforementioned DRPs.

Much of the plan is still in the future -- the first set of pilot projects aren’t expected to go live until 2017 or so -- which makes it hard to gauge how big a new market for distributed energy could emerge from the process. In the long term, however, the opportunities for solar-battery players like SolarCity and Tesla, smart thermostat providers like Nest, or demand-response aggregators like EnerNOC, could be huge. Eventually, each utility could end up having the new rules applied to their multibillion-dollar distribution grid investments called for in their general rate case proposals, the big proceedings that determine utility spending and customer rates for the next three years.

In the meantime, we’ve already seen some conflicts emerge in the record, largely over what utilities are offering third parties so far, versus what those third parties want -- more access to utility data, for example, or an open bidding process for the five rounds of pilot projects that will test DER-grid integration before it's rolled out on a broader scale. The value of DERs is very location-specific -- a UC-Berkeley study showed that only 10 percent of PG&E's feeders saw a benefit from rooftop solar as a resource to defer capacity upgrades. It's also very time-sensitive, with circuits on replacement schedules that could take away the deferral business case altogether for grid-edge solar, storage, or smart thermostats and EV chargers -- unless it's made part of the same process that creates those schedules in the first place.

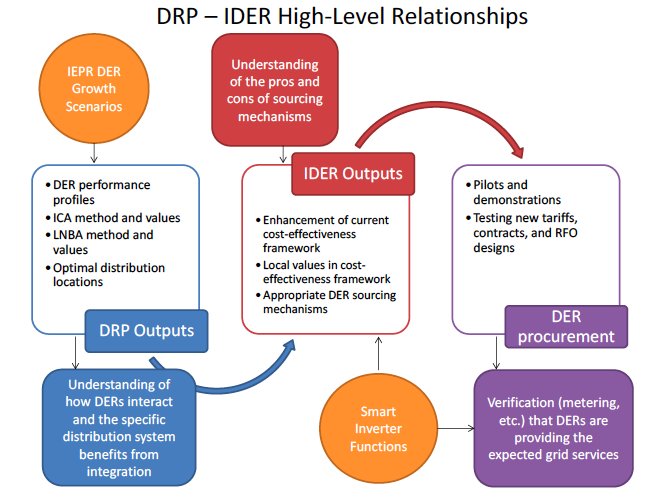

All of this has put the CPUC under the gun to come up with a plan for merging DRP and IDER into a cohesive whole. Earlier this month, CPUC staff held the first official joint workshop (PDF) to hash out how it’s going to proceed, along with a straw proposal that helps clarify the timeline for certain key decisions over the next 12 months. This graphic represents the overall concept, which is to collect the circuit-level DER capacity and locational value data that's being created through the DRP and feed it into the IDER proceeding, which will create cost-effectiveness frameworks and build the sourcing mechanisms -- that is, contracts, or tariffs, or other forms of payment for valuable DERs -- to test out in pilots and procurements.

As for when these succeeding regulatory gears will start to turn, here's the CPUC's proposed timeline, month by month.

January and February 2016

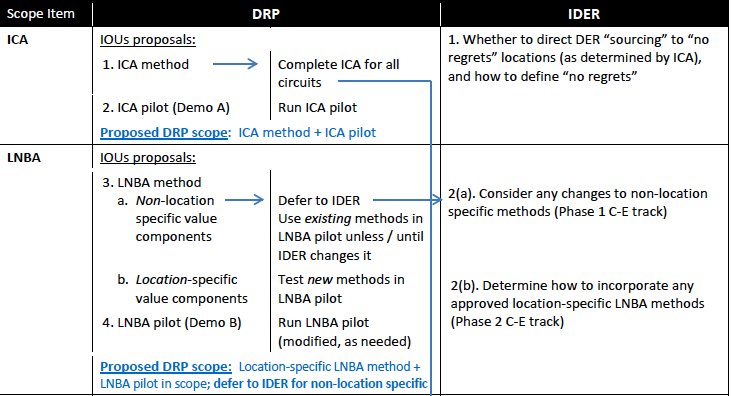

The DRP proceeding has already ordered utilities to come up with two key methodologies for calculating the value of DERs for their distribution grids -- integrated capacity analysis (ICA) and locational net benefit analysis (LNBA). In simple terms, ICA tells utilities the limits of DER capacity at the individual distribution circuit, feeder and substation level, and LNBA tells them what value DERs could provide.

Both of these concepts will have to be tested out in pilot projects to make sure they’re aligning with what’s really happening with DERs on the grid edge. To get there, utilities have proposed two rounds of demonstrations projects, dubbed “A” and “B." [Seriously? -- Ed.]

The CPUC plans to tackle ICA first, given that utilities are further ahead by virtue of the circuit-level capacity maps they started providing online this summer. In January, the CPUC could issue a ruling to “provisionally approve” a version of ICA methodology for utilities to test in their A group of projects.

But it also wants to start moving quickly on LNBAs, with a January workshop aimed at “further improvement, approval and testing” of the methodology, and a ruling as early as February to provisionally approve it for preparing demo projects in the B group.

One of the reasons the CPUC is moving more quickly on these tests is that the stages for testing them have largely already been set, and won’t require additional “cost recovery,” or utilities asking for rate increases to help pay for them. Each of state’s big investor-owned utilities is already collecting data at the distribution grid level, and using software such as Integral Analytics’ LoadSEER, DNV GL’s Synergi Electric, and Cooper Power Systems’ CYME to turn it into dynamic assessments of circuit capacity.

Each has also identified where they’d like to test the ICA and LNBA -- PG&E in the solar-rich Fresno region, SCE as part of its existing Preferred Resources Pilot in Orange County, and SDG&E in its Oceanside territory, where it projects the need for a new substation in the coming years. The CPUC’s timeline projects that by March, the utilities may begin conducing the Demo A and B projects in their chosen areas, with a goal of eventually applying them system-wide.

The first three months of next year will also bring the integration of distributed energy resources (IDER) proceeding into the equation -- and expand to include other scopes of planning beyond the distribution grid.

January’s LNBA workshop, for example, should be “jointly held with the IDER proceeding and activities underway there to ‘unify cost-effectiveness methods’ across DERs,” the roadmap notes. This could be a first opportunity for the IDER folks to submit their opinions about how the DRPs are calculating location-specific benefits for DERs, for example -- and likewise, for the DRP folks to decide which non-locational benefits should be handed over to the IDER folks -- say, their global carbon reduction impact, or the value they represent to customers at large. Here's a breakdown of how the CPUC sees decisions being split between the two proceedings, specifically in terms of fleshing out the rules for ICA and LNBA.

In February, the CPUC wants to hold another workshop to talk about the long-range forecasts for DER growth that utilities are submitting as part of their DRPs, and how they fit into system-wide forecasts coming from the California Energy Commission’s integrated energy policy report, utilities’ long-term procurement proceedings, and the transmission planning process that informs investment and policy decisions by state grid operator CAISO. Getting distributed energy resources into that calculation will require a lot of coordination, which is driving the CPUC to get an early start on the process.

March and April 2016

The first two rounds of pilot projects mentioned above don’t involve actually deploying, networking or managing DERs on the grid, nor do they require new funding to get off the ground. But in March, the CPUC wants to open discussion of demonstration projects C, D and E, which do -- and that will require addressing new questions about utility openness and third-party access.

Project C is the simplest, and is meant mainly to “validate the ability of DER to achieve net benefits consistent with the optimal location benefit analysis” -- in other words, to make sure the LNBA works as it’s supposed to. PG&E and SCE have proposed using the same Fresno and Orange County regions they’ve picked for projects A and B, while SDG&E wants to go out and identify high-value circuits across its service territory.

Projects D and E, by contrast, are supposed to test active management of DERs -- at the substation level for project D, and as a microgrid for project E. These projects will necessarily involve some level of utility-owned assets and systems, such as the distributed energy resource management software (DERMS) that will coordinate DER operations with the needs of the distribution grid. But they’re also required to include third-party-owned resources in the mix in some fashion.

The state’s utilities have already suggested a mix of existing and as-yet-undetermined sites to run these demonstrations. SCE wants to use the same Orange County region for all five of its projects, although it hasn’t yet found the right partner for its microgrid demonstration. SDG&E has proposed using its existing Borrego Springs microgrid for demonstration project E, but wants to seek out high-value circuits across its service area for project D. And PG&E has picked a specific Fresno County substation for its grid demo and Angel Island in San Francisco Bay for its microgrid project.

But none of the utilities have yet provided specific guidelines for how they’ll source the DERs to be included in the projects -- a subject the CPUC wants to broach in April with a joint DRP-IDER workshop, along with a ruling that could open up “initial design activities” for these pilots. That means that utilities will begin designing these pilots before all the data on how to evaluate third-party participants in them has been collected -- while also staying flexible to include feedback from the IDER proceeding.

To keep these design and rulemaking parts of this process in sync, the CPUC proposes to create what it calls a “Demonstration Project Design Working Group,” with utilities and various non-utility stakeholders involved. It will include both the DRP and IDER proceedings, and its first job will be “to use the data and learning from the Demo A and B projects to establish a design and sourcing framework for the Demo C, D and E projects,” starting in May 2016.

May to December 2016

A mid-2016 workshop to discuss cost requirements and targets for the C, D and E projects will be the next workshop for the new working group -- but far from the last. "This joint DRP-IDER working group may meet through the end of the year and can be tied with a series of workshops to discuss the design process for the Demo C, D and E projects," the CPUC's timeline notes.

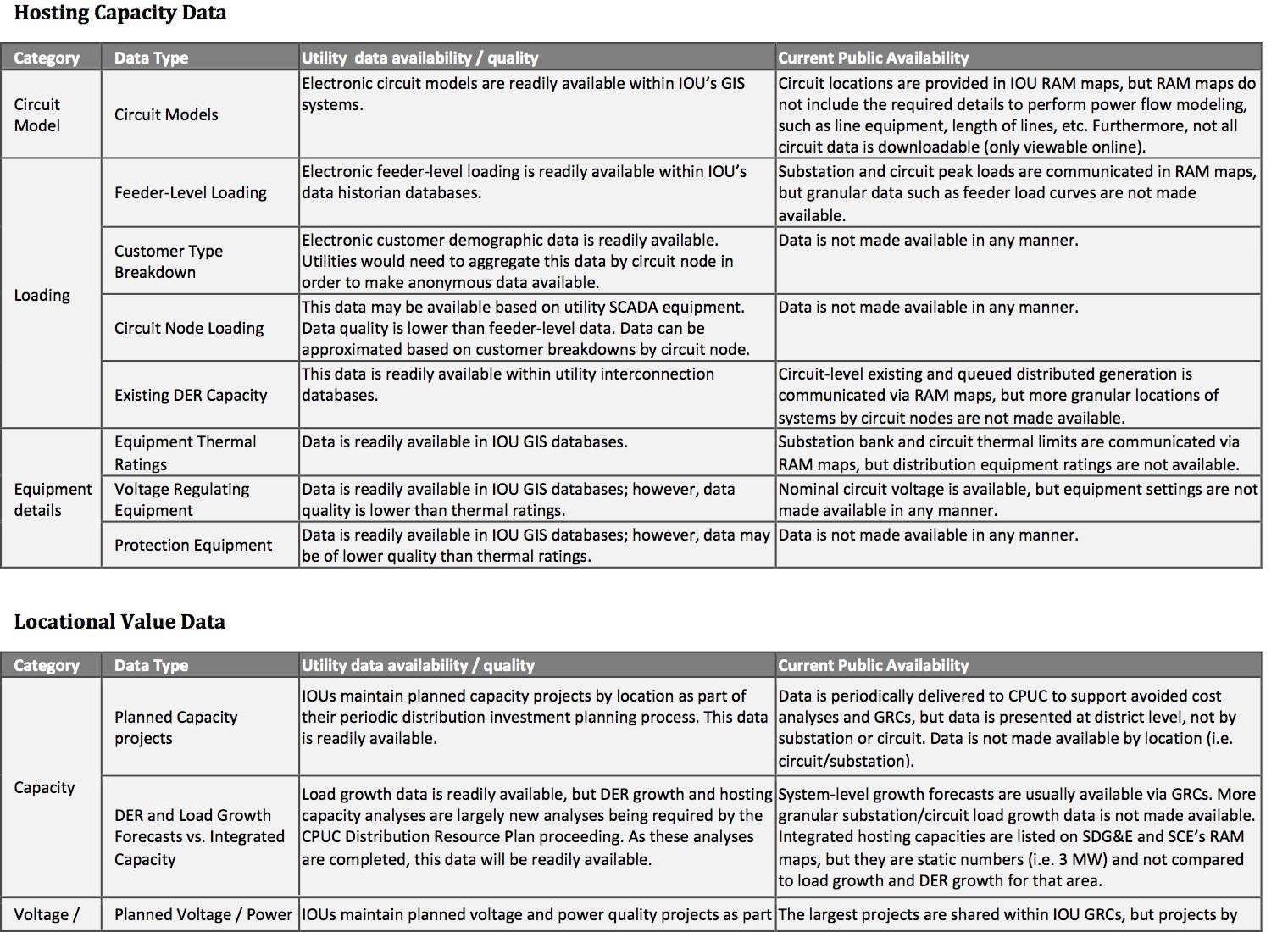

One of the first issues the working group will have to address is data sharing. The CPUC’s straw proposal specifies the need for “rules and procedures for sharing detailed distribution system data, such as powerflow models and distribution system operational parameters, to a level that can support third-party participation in determination of optimal locations for DER" -- in other words, enough data for parties besides the utilities to know where DERs have the most value.

This will include both utilities sharing data with third parties, and third parties sharing data with utilities, the CPUC notes. But so far, we've seen quite a bit of disagreement between utilities and third parties over just how much data should be shared. Utilities have been resistant to sharing real-time grid operational data, for instance, both for security reasons and because it would require expensive upgrades to their distribution grid management systems. Third parties such as SolarCity, on the other hand, have asked for far more granular data, including what the utilities are using for the grid capacity maps and cost-benefit analyses they're presenting to the CPUC.

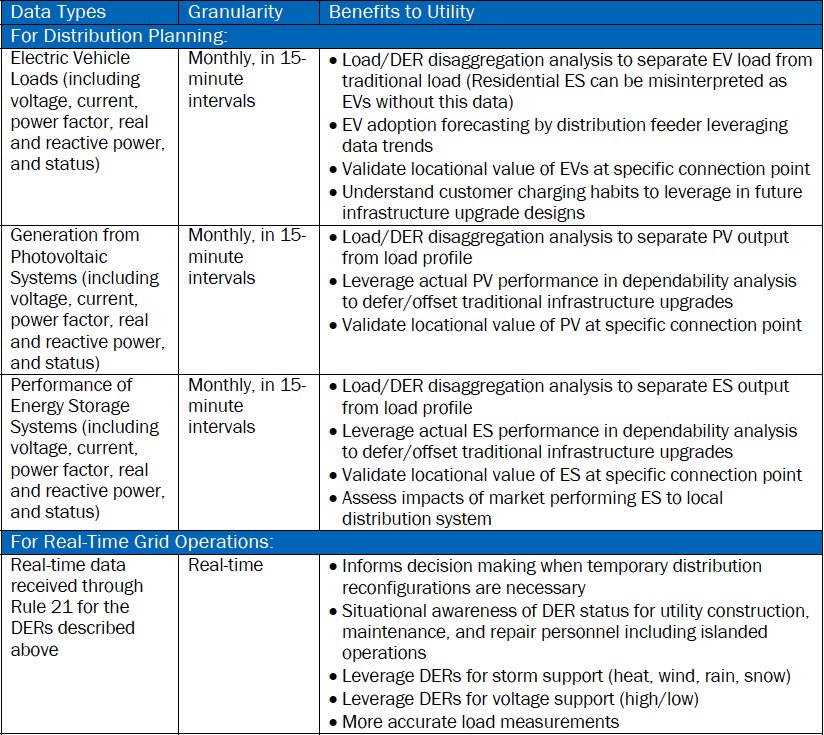

To get a sense of what both sides are asking of each other, here are two charts -- one from SolarCity detailing what it’s asking of utilities, and another from SCE outlining what it wants from third parties.

SolarCity

Southern California Edison

Another key issue before this utility-stakeholder group is how to develop “data communications and other distribution automation infrastructure requirements for support of interconnection of DERs." California’s big three utilities have deployed smart meters and supporting wireless networks across their entire service areas, but those might not meet all the requirements of real-time, two-way command and control of thousands of distributed energy assets at the grid edge.

Building out the hardware, communications and software platforms to manage DERs as dependable, flexible grid assets may take a lot of money and time. SCE, for example, estimates its DRP-related capital expenditures could add up to $347 million to $560 million over the next three years, and PG&E and SDG&E are likely to seek new funding as well.

They’ll also involve some technologies that aren’t even commercially available yet, such as smart inverters. The CPUC has been working for the past two years on defining a core set of advanced capabilities for all new solar PV inverters to be deployed in the state, and is set to start implementing pilot projects to test them next year. Smart inverter specifications are quite complex, and are standing in as a standard to apply to the communications framework being devised for DRP-IDER compliance at large.

That's not the only complication to come into the picture in the second half of the year. The CPUC wants to hold six workshops to consider the implications of its DRP-IDER work for its Rule 21/Interconnection, electric vehicle, energy storage and zero net energy proceedings and vice versa.

2017 and beyond

By the end of 2016, the CPUC could issue a ruling to authorize spending for the C, D and E demonstration projects. But it's in 2017 that the DRP rubber really starts to meet the IDER road, with "two major Decisions (D2 and D3) that can potentially occur" in the year.

The first decision will be the final opportunity for stakeholders to weigh in on the final round of pilot projects before they start. But the CPUC straw proposal suggests that it could also cover broader issues, such as whether to authorize more funding for utility online DER support tools. It could also consider "whether utility requests for distribution system capital project spending in their general rate cases adequately consider DERs" -- a review that could be applied to SDG&E's Sept. 2017 filing of its general rate case for 2019.

The second decision will probably come late in the year, and will be preceded with a workshop that will serve as final call for any suggested "mid-course corrections" or changes to the ICA and LNBA methodologies, demo project funding, or communications and automation infrastructure requirements. Once that's done, the CPUC can close Phase 1 of its DRP proceeding, and move on to Phase 2, which has its own long list of goals for 2018.

In Phase 2, the ICA and LNBA methodologies "will be fully executed," the CPUC says, with results regularly updated through online tools to "support third-party and utility deployment of portfolios of distributed resources that provide grid services for the utilities, as well as other services for customers." That includes data that can show where DERs could help, as well as important data on what kind of DERs could be most useful, with "tools and processes to compare DER as an alternative provider of distribution reliability functions, including voltage regulation." Data from demonstration projects will also start to be available by then, which will help refine work on communications, monitoring and control systems requirements, and could identify "sensors and communications infrastructure for optimal locations throughout all three IOU systems."