When it comes to managing the impact of distributed solar PV on a utility’s grid, it isn’t enough to know that solar installations are booming. You also need to know exactly which grid circuits are getting the most solar.

GTM Research’s new report, Advanced Grid Power Electronics for High-Penetration PV Integration 2014, predicts that the U.S. market for distribution grid power electronics will grow from a mere $25 million today to roughly $300 million a year by 2017, largely driven by the growth of distributed, customer-owned solar. That’s because PV affects grid circuits in multiple ways, none of which are addressed in the design of the one-way alternating current delivery system that must now manage customer-generated two-way power flows.

This is a circuit-by-circuit, feeder-by-feeder type of problem. While most U.S. utilities aren’t close to having enough solar on the grid to worry about it, Hawaii Electric Co. is already seeing many of its feeders overflowing with solar power at midday, and utilities in California, New Jersey and Arizona are starting to see it happening in pockets across their PV-rich grids.

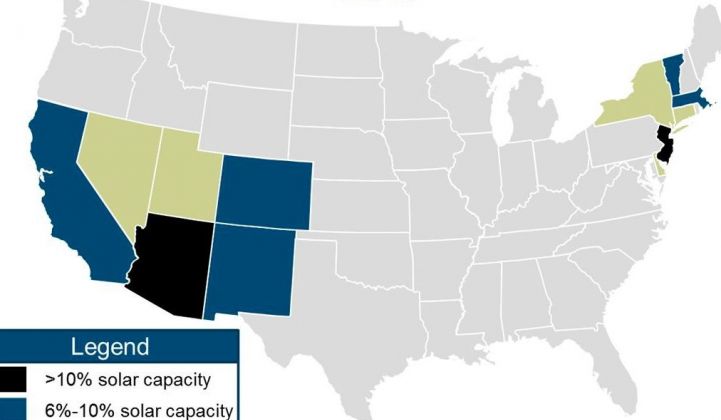

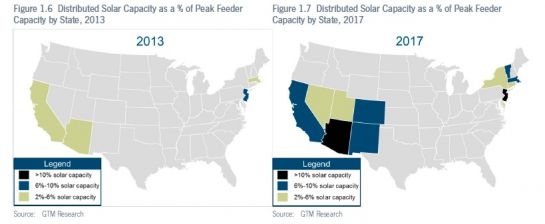

GTM Research Analyst Ben Kellison maps out just where these localized PV challenges are going to emerge first on a state-by-state basis. Here’s his map, showing the change from this year to 2017, in terms of the share of each state’s peak feeder capacity that’s provided by distributed solar:

There’s much debate about how much solar penetration any one feeder line can handle, but the industry rule of thumb ranges from 15 percent to 25 percent. Go past that, and you run the risk of voltage fluctuations, inverter ride-through and drop-off issues, and other two-way power flow challenges that require grid equipment to balance out.

Traditional electromechanical equipment like voltage regulators, load tap changers and capacitor banks aren’t designed to switch on and off or up and down as often as these solar PV-inundated circuits will require, and can wear out much faster as a result, making them several times more expensive as long-term solutions to this challenge.

The other traditional utility method is simply to oversize the power line and transformers, which is expensive but safe. Solar power, however, fluctuates both up and down, meaning that making everything bigger doesn’t necessarily solve all of its problems.

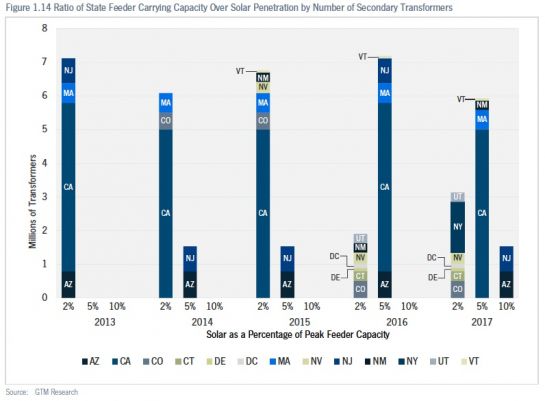

Transformers also suffer wear and tear under variable operating conditions like these, and stand in for a good proxy for the distribution grid equipment exposure that utilities in PV-rich states are facing. This chart shows distributed solar penetration as a percentage of distribution transformers:

Here’s how Kellison sums it up:

“The number of states with more than 6 percent distributed solar versus peak load on distribution feeders is expected to increase from one (Hawaii) in 2013 to more than seven in 2017. These feeders have a total of more than 7 million secondary transformers.”

Will power electronics devices from companies such as ABB, Gridco Systems, One-Cycle Control, Varentec, MicroPlanet and GridBridge provide a cost-effective way to solve multiple PV-inflicted grid challenges? Will advanced “smart” inverters fill in some of these roles -- and will the customers who own the inverters be compensated for their assisting role? How will utilities even know which feeders are having trouble, to guide and manage their initial deployments? For answers to questions like these and more, there’s no better place to go than GTM Research’s new report.

To learn more about the Advanced Grid Power Electronics for High-Penetration PV Integration 2014 report, please visit http://www.greentechmedia.com/research/report/advanced-grid-power-electronics-for-high-penetration-pv-integration-2014.