Cogenra says it is now selling its low-concentration PV at $0.50 per watt.

“It’s not magic,” Cogenra CEO Gilad Almogy said of the remarkable price point for his company’s new T14 LCPV system. “Lots of people are working to bring down CPV costs. They did two things wrong: They bet against silicon, and they tried to bring a fifth-generation product to market right away. We believed the price of silicon would come down, and we grew our technology through iterations.”

Cogenra will deliver its newest LCPV modules at the $0.50 per watt price, and at a 20 percent reduced LCOE, for its first megawatt-scale T14 installation at the University of Arizona Science and Technology Park solar zone. Financed by Washington Gas Energy Systems and awarded a power purchase agreement by Tucson Electric Power, construction is scheduled for early 2014.

Before the launch of the new T14 system, the Khosla Ventures-backed Cogenra was focused on its unique hybrid solar hot water-solar electricity concept: parabolic trough mirrors, assembled from flat-plate mirrors, mounted on single-axis trackers. They concentrate the sun’s light fourteen times onto high-efficiency silicon PV panels along a water cooling system that absorbs the reflected heat. The panels generate electricity. The captured heat, which serves hot water needs, roughly doubles the system value, according to Almogy.

But first and foremost, Cogenra's technology is “a low-cost concentrating PV system,” Almogy said. And the new pricing breakthroughs are “not a revolution but an evolution” of the firm's LCPV technology.

The T14 system uses fourth-generation Cogenra modules. “With 30 to 40 installations, we learned enough and improved enough to get to our [current] price,” Almogy said.

The cost of the system’s optics is “very, very low.” The reduced-cost cooling system “keeps the solar cells cooler, allowing a higher power output.” And the new product’s architecture requires 10 percent less land, while remaining “fully compatible with industry-standard balance-of-system components, field layout and installation.”

Cogenra’s cell vendors have also evolved their efficiency and cost, Almogy added. “Two years ago, there was only one company that had high-efficiency cells. Now the world record for monocrystalline silicon cell efficiency is 24.7 percent, and there are three or four other companies that have efficiencies over 23 percent.”

Part of the advance is because silicon has become more efficient over the last year, driven by Japanese companies after Fukushima, Almogy said. “High-efficiency silicon is more expensive, but since we use so little, it only increases our cost slightly.”

“This is a new product for Cogenra, and the cost target of $0.50 per watt will have to be validated,” Raymond James energy analyst Pavel Molchanov said. “But as far as solar startups go, Cogenra has a pretty good track record.” Hitting that $0.50 price would be, Molchanov added, “a potentially disruptive innovation in the solar industry.”

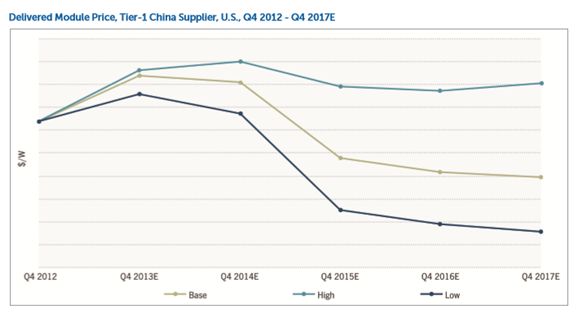

Just how disruptive it would be is clear from an observation in GTM Research’s just published Global PV Pricing Outlook 2014: Value Chain Trends, Global Drivers and Regional Dynamics report: “Looking into 2015 and beyond, module pricing will resume its long downward trajectory, eventually hitting $.50 per watt for Tier 1 Chinese modules in the base forecast.”

Cogenra beat out several other CPV technologies in a competitive solicitation run by Tucson Electric Power's Wholesale and Renewables Director Carmine Tilghman. It joined Amonix as the only other trial CPV technology selected by TEP for the University of Arizona’s Tech Park.

Tilghman would not disclose the PPA price and could not confirm the cost per watt or LCOE. “My guess is Washington Gas would not have procured the project if they weren’t comfortable with Cogenra’s ability to deliver at the promised price point.”

High-concentration CPV technologies like those employed by SolFocus, Amonix, Soitec, and Solar Junction have struggled. They can get 500 times to 1,300 times concentrations and achieve much higher efficiencies, Almogy told GTM, but at a much higher cost because of more expensive optics, module materials, and tracking systems.

“Two years ago, when silicon was very expensive, that seemed like a viable solution,” Almogy said. But the price of silicon has dropped and Cogenra’s commitment to it has paid off.

Despite that and the many cost-saving improvements Almogy described, when pressed repeatedly for validation of the remarkable price point claim he makes for the new system, he finally could only say, “Give me a purchase order and I will send you modules at $0.50 per watt.”

Source: GTM Research’s Global PV Pricing Outlook 2014: Value Chain Trends, Global Drivers and Regional Dynamics