The case for smart grid, and smart meters in particular, is dicey for many large utilities that are not always incentivized for efficiency. But most of the 2,000 or so municipal utilities across the United States purchase power they don't generate -- and they're desperate to save money through smart grid technologies, especially during these cash-strapped times.

That's one of the factors that is going to make the municipal utility sector one of the largest drivers of smart grid investment over the next five years, according to a new report by GTM Research, "The Muni Smart Grid 2012: A Survey of Utility Deployment, Expenditure and Strategy." While municipal utilities only serve about 13 percent of electric customers in the U.S., they are expected to spend $4.5 billion to $9 billion on smart gird from now until 2017, the report found.

Seventy-two percent of municipal utilities surveyed said that smart meters are a prerequisite to the utility’s vision of a smarter grid. GTM Research expects RF mesh to dominate in this market, with RF point-to-multipoint coming in second. Munis will also likely be looking for platforms that can support distribution automation applications, which respondents said was the second most important application of smart grid.

But the smart grid industry is going to have to adjust to meet the needs of the municipal utility sector. One of those needs is a lower-cost approach to meet the smaller customer base of a lot of municipal players. While there are a few huge munis, like the city of Los Angeles, the majority serve 1,000 to 10,000 customers, with an average size of about 64,000 customers for those utilities surveyed by GTM Research.

Another key finding of the survey is that municipal utilities are largely in the planning or investigatory stage of smart grid, with only 14 percent saying they were already moving forward with a large-scale deployment. While that's an indicator of opportunity in the sector, it's also a sign that so far, many municipal utilities are still concerned about price and payback for the systems they'll be asking their ratepayers and elected city officials to pay for.

That also pushes municipal utilities to want to leverage smart grid platforms for multiple purposes. For instance, while advanced metering networks can’t necessarily meet all the requirements for bandwidth and latency for distribution applications, 41 percent of respondents said that current AMI network solutions could meet their DA needs.

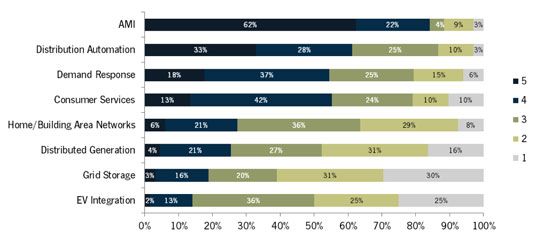

The chart below shows the responses to the question, "What do you consider to be the most important application of smart grid?"

Source: The Muni Smart Grid 2012: A Survey of Utility Deployment, Expenditure and Strategy

The need for one-stop shopping is increasingly important for utilities, which are looking for vendors that have extensive partnerships to meet all their needs or layered solutions depending on what smart grid applications are needed.

For some utilities, that means waiting for vendors that can offer what they want at the right price. Palo Alto, for example, couldn’t justify the total cost of an AMI system for its water, gas and electricity systems. One of the largest costs was the meter data management.

One solution from MDM vendors, like eMeter, is to offer full solutions across water, gas and electricity, which can help drive down cost. About half of the utilities said they also had plans for smart water investment in the next five years. The GTM Scott AMI Market Tracker predicts 2012 will see 5.5 million smart water meters networked, up slightly from 5.3 million in 2011. Burbank Water and Power, for example, was moving faster with its water smart meter project than its electric smart meter deployment, so it needed an MDM solution that could handle both from day one.

Other companies are teaming up to tackle the co-op and muni market. On-Ramp Wireless and ElectSolve partnered earlier this year to provide an integrated smart meter and grid monitoring solutions specifically for smaller utilities.

The large meter makers are also making a play for the municipal market, either by highlighting their offerings across gas, water and electricity, or by talking about end-to-end offerings within the electric sector. Itron, for instance, is one of the largest providers of smart water meters in the U.S. and recently announced a large project in Australia for four million smart water meters with Sydney Water.

In California, the Southwest and the drought-stricken Midwest, water conservation could be a key driver for investment in smart water meters, which could also help to drive electric smart grid investment, as there can be savings in economies of scale. Cities are still tight on money, however, and the market is responding to that with various offerings that are tailored at the smaller utilities that can’t spend first and hope for savings later.

General Electric (NYSE: GE) is rolling out its smart-grid-as-a-service platform at multiple municipal utilities, and competitors like SAIC's (NYSE: SAI) smart metering service offering, IBM’s (NYSE: IBM) smarter cities platform and Lockheed Martin’s (NYSE: LMT) demand response platform for electric co-ops are also targeting the market.

Of course, with new platforms comes a wave of data. Half of muni utilities said they were “highly concerned” with the challenges related to big data that a smarter grid may bring. The other half was “mildly concerned.” More than half also said that consumer energy data was the property of the utility, rather than the customer, but that could be seen as an improvement from a year ago, when nearly half of respondents didn’t know who owned the data.

Many small utilities are interested in potential cloud applications for smart grid, if they could be delivered with the right security precautions. But the questions and uncertainty about data and overall costs are why most munis are still in the planning phases.

For more information on the report released today, visit http://www.greentechmedia.com/research/report/the-muni-smart-grid-2012/ or contact Tate Ishimuro at [email protected]