Small and medium-sized businesses are the redheaded stepchildren of energy management. There’s a bottomless pool of companies vying for homeowners' attention, and a slew of professional services for the large commercial and industrial energy customers.

Stuck in the middle, and often forgotten, is the small and medium-sized business (SMB) market. Utilities and other energy management providers want to address SMBs, but because the SMB market is fragmented, many don’t know where to start.

In recent years, however, there is increasing chatter about serving this substantial market. To answer some basic questions, Accenture launched its first global snapshot of the sector. In the report, New Energy Consumer Handbook, Accenture surveyed businesses with one to 500 employees across nine countries.

At first glance, it seems as though SMBs are pretty happy with the status quo. But dig a little deeper and it seems that’s hardly the case. “When you dig around, they’re much more price-sensitive, much more likely to switch, and becoming much more organized than we thought,” said Greg Guthridge, global managing director for Retail and Business Services for Utilities at Accenture.

The churn rate for SMBs is high, the study found, with about 35 percent of participants saying they’re considering switching energy providers. The opportunity to get, and keep, the energy management business for small business is going to be huge in coming years -- and not limited to utilities.

1.Tailor the Experience. A total of 87 percent of small and medium-sized businesses want targeted solutions for their business needs. Nearly half of the companies don’t even care if those are specific to their industry, as long as they’re designed specifically for SMBs.

Guthridge suggests there are two actions utilities can take that don’t require a significant investment. The first is to create a call center within a call center just for the SMB segment. The other is to bring in a few extra people that can serve as industry representatives. The reps should know the business cycles of specific industries, such as retail, and be able to talk with both accounts payable and business owners about managing energy and taking part in energy efficiency programs.

2. Design Specific Rate Plans. There is a notion in the industry that the small business owner doesn’t have the time or inclination to sign up for variable rate plans. But Accenture found that more than half of survey participants would opt for a variable rate plan if it saved them money.

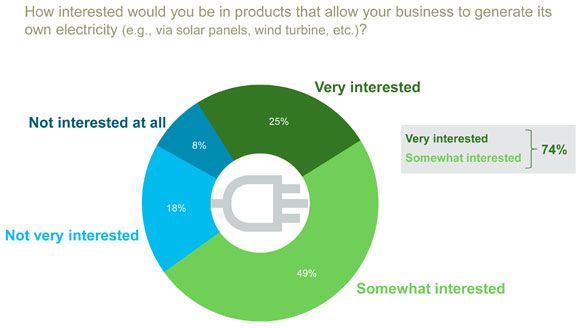

3. Offer Value-Added Services. Many services that are popular with residential customers are also sought after by SMBs, including bill alerts and plans that make bills more predictable. More than half of SMBs say they have already had energy audits or are interested in them, and another 41 percent are interested in devices to help manage energy use (automated lighting or HVAC with remote controls). Even more, 74 percent, were somewhat or very interested in generating their own electricity. Not only are business owners interested in tailored services, but over half even said they’d be willing to pay more for them.

4. Know the Business Cycle. A bill insert might not be the best way to engage the small business community. Instead, SMBs would prefer to address energy-related products when they’re budgeting for the following year or renewing a contract with an energy supplier.

5. Know the Competition. Many small businesses had a hard enough time weathering the recession, so anywhere they can save money, they will. While SMBs generally trust their utility, they would happily take energy management services from other providers, including retailers, energy brokers or phone or cable providers, according to Accenture’s findings. Guthridge also noted a “very strong trend” of aggregation, whereby small businesses are banding together to pool their purchasing power.