Every quarter, GTM Research’s grid edge analysts compile the most important data and findings from the past three months for Grid Edge Executive Council members. We've tapped into the Q4 2015 Grid Edge Executive Briefing to showcase a few of those findings across mergers and acquisitions, AMI deployments, demand response, microgrids and energy storage.

$16.4 billion in grid edge M&A

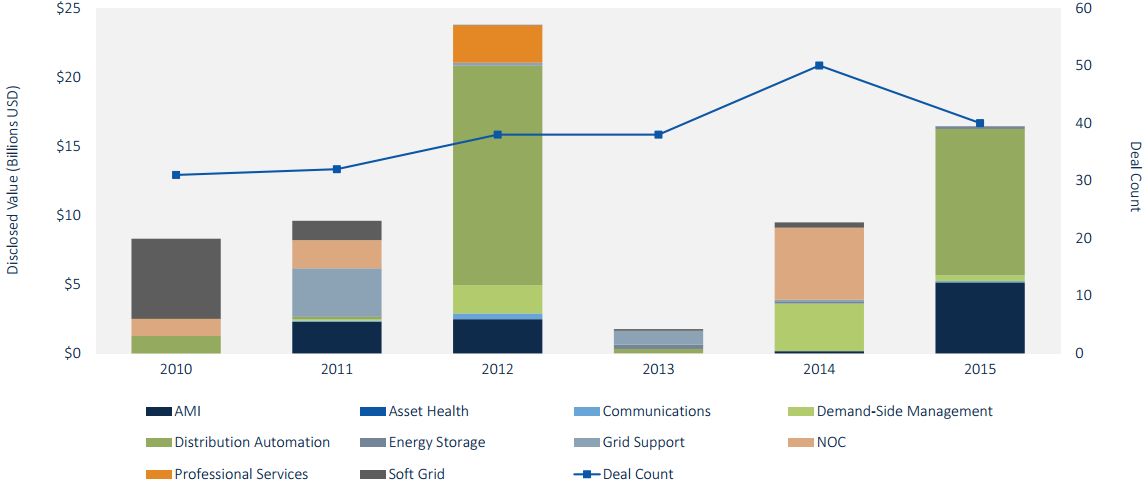

GTM Research tracks investment, private equity, mergers, and acquisitions across the grid-edge landscape. In 2015, there were 40 deals in energy storage, AMI, distributed automation and other grid-edge markets that together totaled $16.4 billion. The report points to GE's acquisition of Alstom's power and grid businesses and Honeywell's acquisition of Elster as the most significant activity in the space.

"Beyond the two largest deals of 2015, a dozen small deals point to the increasing focus on energy management solutions for C&I customers. Duke Energy, EnerNOC and Acuity Brands are a few of many energy solutions providers that see strategic value in offering a broader set of capabilities for optimizing their customers' energy spend," wrote GTM Research Grid Analyst Andrew Mulherkar.

Source: GTM Research Grid Edge Executive Briefing

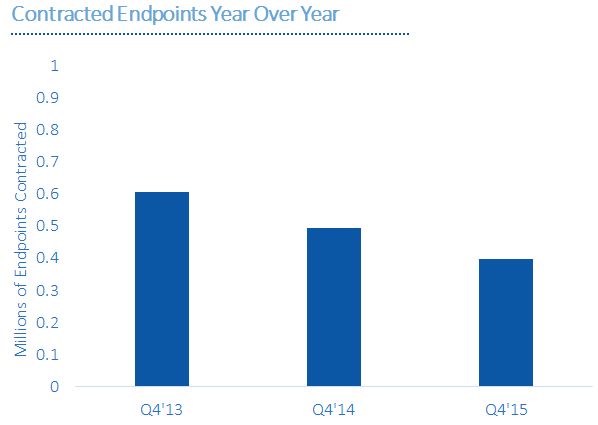

398,000 AMI endpoints

Down on a year-over-year basis, the U.S. AMI market experienced a slow fourth quarter, with just 398,000 AMI endpoints contracted. According to the report, the only major contract was the City of Memphis' tender for 375,000 endpoints. The global AMI market grew in 2015, however, due to increasing volume from international orders.

Source: GTM Research Grid Edge Executive Briefing

Tender activity increased significantly in early 2016, with major contracts announced for Seattle City Light and Consolidated Edison.

According to GTM Research Analyst Aakriti Gupta, "Con Edison recently contracted 3.3 million endpoints, representing the fourth-largest AMI rollout in the U.S. This deployment will be fundamental to advanced analytics use cases, including load forecasting, demand response and theft detection and will be in support of New York's REV mission."

Supreme Court upholds FERC Order 745

It was five years in the making, but in January, the Supreme Court ruled 6-2 to uphold FERC Order 745 on demand response (DR) compensation in organized wholesale energy markets. According to the report, "The Supreme Court acknowledges that matching supply and demand has evolved into a competitive interstate business and FERC's role needs to evolve accordingly. FERC continues to have the authority to regulate demand response in U.S. wholesale energy markets, in addition to allowing DR to be compensated at the locational marginal price."

The U.S. demand response industry was valued at $1.4 billion in 2015, according to GTM Research.

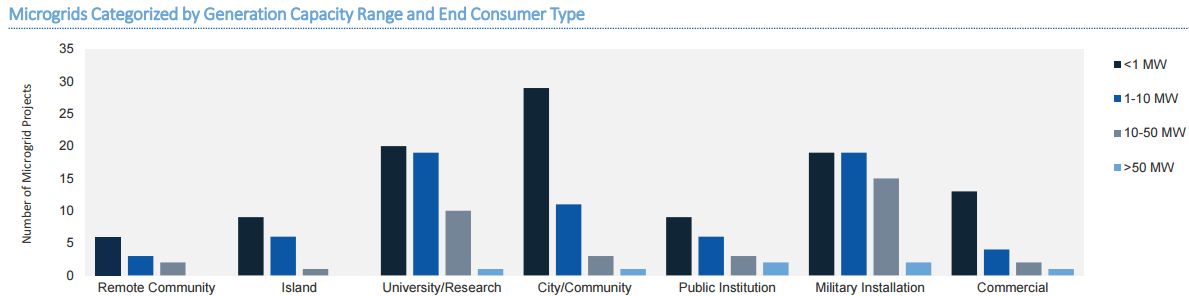

Microgrid use continues to diversify

Microgrids vary by size and use case. While about half of microgrids in the United States are less than 1 megawatt, 20 percent are 10 megawatts or more. Military applications are the most common, followed closely by university/research facilities and then by cities and communities.

Source: GTM Research Grid Edge Executive Briefing

“In the near term, we expect to see continued development of 1-megawatt microgrids, reflecting the increased demand for reliability by critical-infrastructure-oriented projects serving smaller behind-the-meter loads,” said Omar Saadeh, a senior analyst with GTM Research.

“As large consumers of energy look to reduce energy spend and as utilities become more interested in microgrids for local grid services, new co-ownership models that better distribute costs and benefits between both stakeholders may ultimately accelerate adoption of larger-scale projects in the long term,” he said.

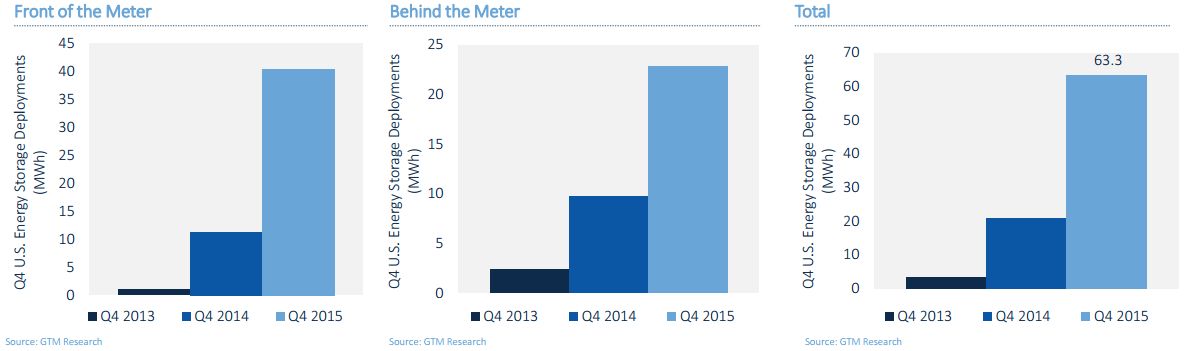

63 megawatt-hours of energy storage in Q4 2015

The United States' energy storage market experienced its best year ever recorded. In the fourth quarter, 63.3 megawatt-hours of energy storage were deployed, a threefold increase over the fourth quarter of 2014.

Source: GTM Research U.S. Energy Storage Monitor

"2015 front-of-the-meter deployments continued to be dominated by the PJM market," wrote Brett Simon, a GTM Research storage analyst. "While California led non-residential deployments, Hawaii was the top residential energy storage market in 2015, driven in part by changes to the state's net metering policy in the second half of the year."

***

Grid Edge Executive Council members receive quarterly slide-based market briefings from the grid edge analyst team. For more information on the Grid Edge Executive Council, download the brochure here or contact Tate Ishimuro at [email protected]