Adam James and the GTM Research team have initiated coverage of Latin America's solar industry with the Latin America PV Playbook. Thursday's webinar provided a glimpse into this ongoing regional research.

As we've reported, Latin America is about to find out whether unsubsidized solar can be an economic market reality. "You don't need incentives for solar," said James in an earlier interview, suggesting that any market can grow as long as there is a transparent regulatory process -- along with high tariffs and high DNI.

Latin America will install more than 700 megawatts in 2014 and is poised for a pace of market growth that will rival the U.S. According to James, “The Latin American market as a whole represents a huge opportunity for PV. However, the complexities of local markets, financing and regulatory hurdles, and policy risk have all played a role in preventing solar development in the region from reaching its true potential.”

Here are five takeaways from a webinar that covered a lot of ground.

Global demand is becoming more diffuse

The EU once accounted for 80 percent of global solar market demand. Today, the Asia-Pacific region accounts for 50 percent of the market as the market continues to broaden and expand. Latin America will account for 2 percent of global demand over the next four years, according to GTM Research.

Project developers in Latin America face a volatile future

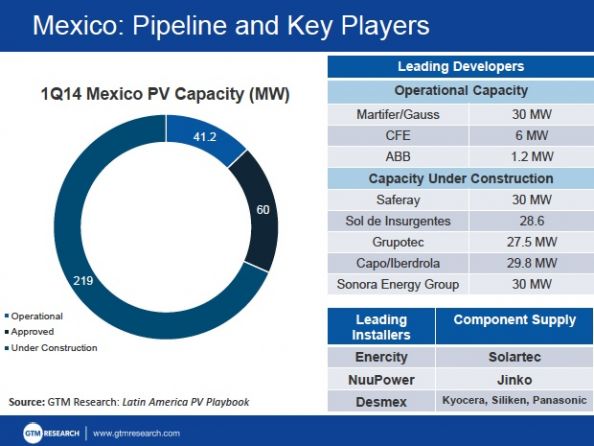

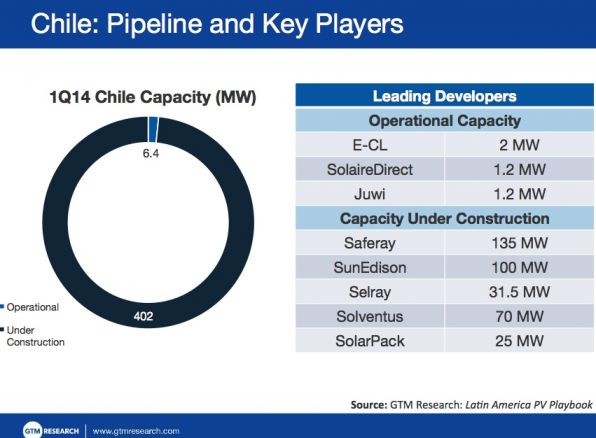

A consistent theme across the region is that the downstream channel and project development sector is active and volatile. Today's list of leading developers, which includes Martifer, CFE, ABB, MPX, Cernig, juwi and Solairedirect, could soon give way to an entirely new list including saferay, Grupotec, Selray or SunEdison in the years ahead. Martifer already has a 30-megawatt merchant solar project with CFE in Mexico, while solar power plant developers SunEdison, SunPower and First Solar have merchant solar projects in development in Chile.

The 3 countries to watch are Mexico, Brazil and Chile

Like the U.S. five years ago, these markets are poised for gradual, steady growth, but they are complex and not without risk. Mexico is driven by distributed generation, self-supply and the country's small power producer program. The IPP program will be less of a force, according to GTM Research. Brazil's solar market will be driven by DG and the state, as opposed to the federal IPP tender. Chile's market will be driven by PPAs and merchant solar.

Mexico

Mexico has the framework for a growing solar market, both distributed and utility scale. As reported by GTM Research, net metering was enacted in Mexico in 2007 and is administered by the Comisión Federal de Electricidad (CFE), Mexico’s state-owned electric utility.

In most regions, once a user consumes more than 150 kilowatt-hours, the DAC rate (“De Alto Consumo,” or high consumption rate) is triggered and bumps up the price to as much as 22 cents per kilowatt-hour.

Solar is "incredibly competitive" at the 22-cent DAC rate, according to James. He also pointed out that Mexico's network must move solar power from the high-DNI north to population centers in the south. Installations up to 500 kilowatts do not require regulatory approval from the CRE, while self-supply installations over 500 kilowatts do require approval and can provide power to multiple offtakers. James pointed out that residential solar installers have focused on high-income clients first, focusing in areas with high insolation and targeting consumers who are likely to be paying the DAC rate.

There are currently 219 megawatts of utility PV projects under construction across all states in Mexico, nearly half of which are in Baja California Sur. The Mexican solar market’s demand will quadruple from 60 megawatts in 2013 to 240 megawatts in 2014, driven by projects approved under the Small Power Producers Program, strong residential demand, and self-supply projects for commercial, industrial, and agricultural customers, according to GTM Research.

With high insolation and a supportive regulatory body, Mexico is the most attractive near-term solar market in Latin America, according to the analyst.

Leading developers in Mexico include Martifer, CFE and ABB, but the market is small and volatile and other developers will lead in the coming years.

Brazil

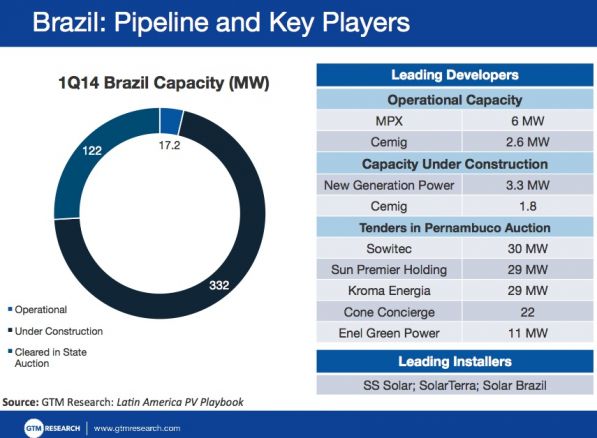

GTM Research has revised its demand expectations for Brazil up from 144 megawatts over the next two years because of the Pernambuco state IPP auction. Unlike Mexico, the areas of highest insolation overlap with major population centers in Brazil, but transmission constraints remain, and retail rates are ~15 cents per kilowatt-hour. The hype surrounding the 2014 World Cup in Brazil will usher in increased solar installations as well.

Leading developers include MPX and Cernig.

Chile

Chile boasts some of the world's highest DNI in the Atacama desert. The country contains four grids: two cover the majority of the territory and one serves the mining companies. There is a need for new capacity, and mining companies often have to buy on the spot market.

Adam James notes that offtakers such as mining firms can have unrealistic expectations about PV pricing. And because mining companies are highly exposed to commodity fluctuations, they are often reluctant to sign new long-term contracts. James cites the example of an 8.7-megawatt PV project that was delayed because of a poor commodity outlook for mined iodine.

James sees Chile having a watershed year in 2014, but he warns of capacity issues and unrealistic project announcements.

Don't Overlook Peru, Argentina, Uruguay and the Caribbean

There are potential growth markets in other Latin American countries, all of which are explored in the PV Playbook.

***

The Latin America PV Playbook is the most comprehensive analysis available of the Latin American solar market. The annual subscription includes a 50-slide Latin America Solar Essentials report, 70-slide quarterly market updates, and an ongoing project database complete with developers, suppliers, timelines and costs. Markets covered include Mexico, Chile, Brazil, Peru, Central America, and the rest of South America. For more information, visit http://www.greentechmedia.com/research/report/latin-america-pv-playbook.