A handful of states account for the majority of solar photovoltaic installations in the U.S., but policymakers across the country are taking up the issue as solar power gains traction coast to coast.

All but four states took up some type of policy action regarding distributed solar power in 2015, according to a new report from the NC Clean Energy Technology Center.

Many of the headlines have focused on changes to net metering, especially in Nevada, Hawaii and California.

“The last quarter of 2015 has demonstrated that states and utilities are responding to the increase in distributed generation in radically different ways,” Kathryn Wright, study co-author and consultant at Meister Consultants Group, said in a statement. “Nevada’s decision to roll back net metering and California’s continued support of retail-rate net metering illustrate the stark contrast.”

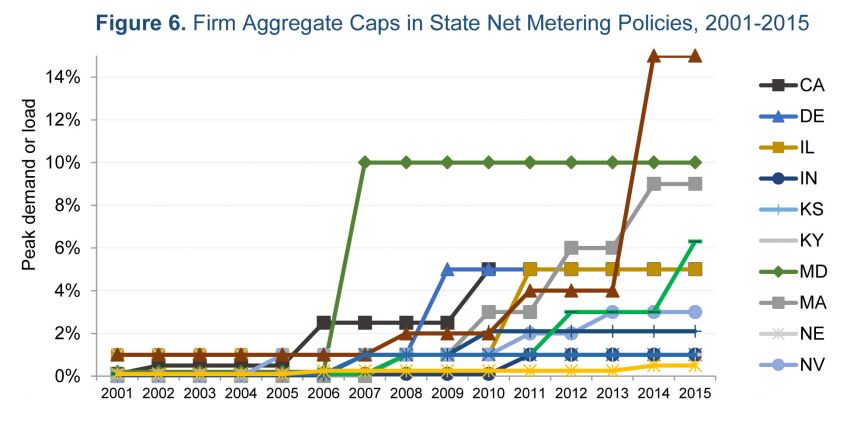

In many other states, however, it is not wholesale changes to net metering, but rather examining elements of net metering -- such as caps to the program -- that have come to the forefront.

Source: NC Clean Energy Technology Center

Utilities from Louisiana to Maine hit their metering caps in 2015. Massachusetts, the fourth-ranked state in the U.S. for annual PV installations for the past three years, failed to pass a bill that would have lifted the net metering cap for commercial solar at the end of 2015. On the other hand, New York, another leading solar state, lifted net metering caps as it moves forward with its Reforming the Energy Vision proceeding.

The increased scrutiny comes at a time when solar is growing rapidly. The U.S. saw a 17 percent year-over-year growth rate for solar PV in 2015, with 13 states installing more than 100 megawatts each during the year, according to new data from GTM Research.

For the first time in history, solar outpaced new natural-gas capacity additions, with solar making up nearly 30 percent of new electric generating capacity in 2015. States including Georgia and Utah shot up in the rankings.

Because of the growth of solar, many legislatures are rethinking their solar strategy before they experience the penetration levels seen in some early-adopter states such as California and Hawaii.

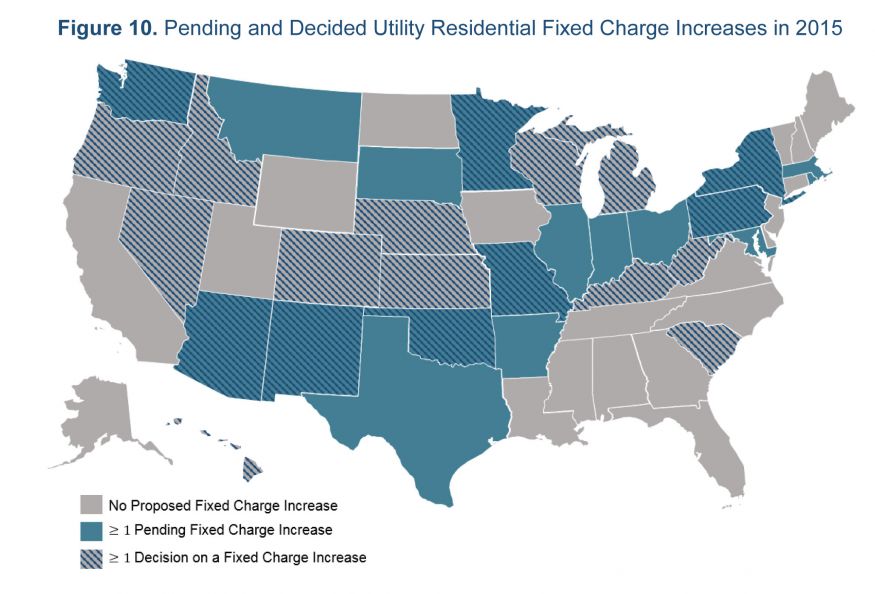

In many cases, lawmakers and regulators are responding to pressure from utilities. In 30 states, utilities are pushing for higher fixed charges, according to the study. In most of the cases settled in 2015, utilities received an average fixed charge of $10.85 up from $9, but far lower than the average proposal of $17.25.

Source: NC Clean Energy Technology Center

But higher fixed charges and issues around whether customers will be paid the retail rate of electricity for excess generation are only scratching at the surface of the challenge of coming up with a new rate structure that values the grid and distributed generation.

Nearly half of the states in the U.S. are examining or planning to examine at least some element of the value of distributed generation.

Maine is far from a leading solar state, yet its Public Utilities Commission already conducted a value-of-solar study that found the value was $0.33 cents per kilowatt-hour, far higher than the average retail rate. Minnesota set a value-of-solar tariff in 2014 and has opened a grid modernization proceeding at the state level.

For a few leading states, such as Hawaii and New York, the goal is not just to value solar more broadly, but to entirely rethink the value of grid services on the distribution level.

In other states, it’s far narrower. In Florida and Ohio, the study notes that the solar studies were performed with the primary goal of providing information to commissioners. In West Virginia and Oregon, the proceedings only looked at the cost-shifting element of net metering.

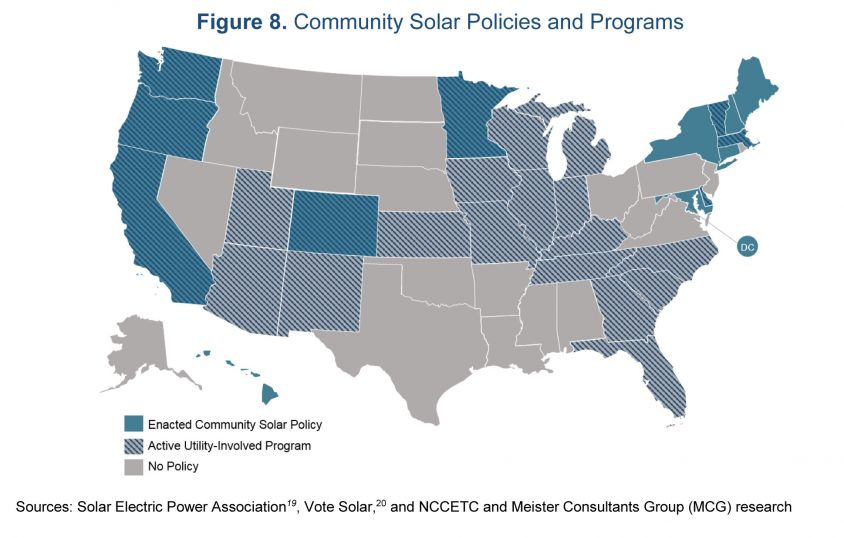

A trend on the horizon that will require more states to take a look at solar policies is community solar. Only seven states and the District of Columbia had policy action on community solar, but another seven states have enacted community solar legislation.

Graph: NC Clean Energy Technology Center

With many states taking a closer look at solar, it is possible that some won’t wait as long to lay out comprehensive policy for community solar as they have when it comes to rooftop solar. Even so, given the different regulatory drivers in each state, there will likely only be more variation rather than consensus in the future.

“Although the stated end goal of many of these inquiries and studies is to come to a more thoughtful, data-driven understanding and policy direction for distributed generation,” the report states, “it is still largely unclear what, if any, trends will emerge.”