The business case for energy storage can be made in many different ways, but it helps when storage has a clear place in the local energy market.

The Federal Energy Regulatory Commission took solid steps with Orders 755 and 784, but there’s even more happening in a few states that could show the way forward for the rest of the country.

Despite the federal directives, “changes at the state level are most likely to help expedite the deployment of energy storage, particularly for behind-the-meter assets,” according to a new GTM Research report, Distributed Energy Storage 2014: Applications and Opportunities for Commercial Energy.

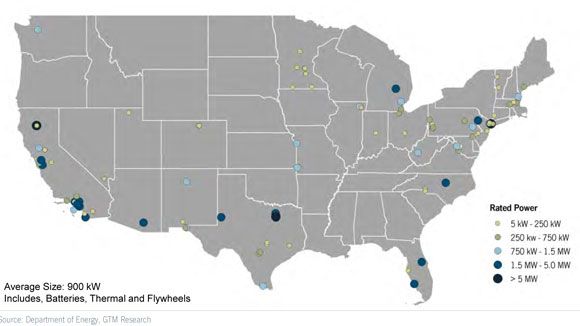

Greentech Media has been keeping an eye on the states highlighted in the graphic below for years when it comes to energy storage, but changes in just the past twelve months have made these markets even more attractive.

Here are the top three states to watch in the short term.

California

If you’ve been watching the energy storage market at all, you know California is where the action is.

First it was the 2010 bill AB 2514, which mandated that the California Public Utilities Commission consider requiring energy storage. That process finally culminated last year with the CPUC calling on the state’s three large investor-owned utilities to procure 1.3 gigawatts of energy storage by 2020.

There is also the state’s Self-Generation Incentive Program, which offers credits for on-site generation and includes credits for energy storage that can store power from those on-site systems.

The program’s 2013 budget was $77 million, nearly $60 million of which was divided among Pacific Gas & Electric and Southern California Edison, with California's Center for Sustainable Energy and Southern California Gas Company receiving the rest of the money. In 2012, nearly one-quarter of the applications were for advanced energy storage systems when measured by capacity.

Mandates help, but so do high demand charges, which make storage more cost-effective, if it can help utility customers avoid those charges. Companies like Stem, Tesla and Eaton are all planning SGIP storage projects that will help customers go off the grid when prices are highest.

New York

Far from sunny California, the New York market has many similar drivers, including high demand charges and new storage incentives.

“New York (and in particular New York City) is one of the most dynamic and fastest growing markets for distributed energy storage due to both a unique set of circumstances and the presence of stakeholders that have driven the market forward,” GTM smart grid analysts wrote in the new report.

NYSERDA and Consolidated Edison, which serves New York, proposed 100 megawatts of load reduction earlier this month that will include energy storage, demand response and energy efficiency. Energy systems that can provide on-peak reduction will pay $2,600 per kilowatt for thermal storage and $2,100 per kilowatt for battery storage systems.

New York Governor Andrew Cuomo is also supporting R&D efforts in the state, with a $23 million public-private investment in an upstate battery storage test and commercialization center announced last year.

The state’s independent system operator, NYISO, already allows energy storage to participate in day-ahead and real-time wholesale markets, although most of those opportunities are limited to large-scale systems. NYISO was the first electricity market in the U.S. to implement rules allowing storage to participate in frequency regulation services, and it followed PJM to become the second grid operator to implement FERC Order 755. Although the market mechanisms exist, “the frequency regulation market in New York state is relatively unattractive compared to the one that exists in the neighboring PJM territory,” according to the GTM Research report.

Even if the frequency regulation market is not a compelling enough reason to invest in storage, post-Sandy reliability and high power prices will likely propel the market in coming years. And it’s not just large facilities that are investigating storage; neighborhood 7-Elevens are investing in storage and seeing some impressive reduction in peak charges.

Texas

Texas may not be under FERC jurisdiction, but that doesn’t mean the state’s grid operator, ERCOT, isn’t assessing changes to its energy markets to make them friendlier to energy storage and demand response.

GTM Research sees Texas as a market more likely to adopt transmission-level energy storage, but that could change. Market caps on energy prices will soar to $9,000 per megawatt-hour in ERCOT next year, which makes hedging energy costs during peak increasingly important. ERCOT has also instituted an operating reserve demand curve, so prices should go up more often as capacity becomes scarce, even if it doesn’t hit the highest thresholds.

ERCOT is currently finishing up a fast-responding regulation service pilot, which includes a 36-megawatt battery and electric delivery trucks. Like New York, however, the clearing prices for frequency regulation are still far lower than they are in PJM.

ERCOT is revamping all of its ancillary services, however, and could address the pricing scheme. If those changes also include more opportunities for behind-the-meter storage, Texas could become a significant market.

Batteries and fast-responding services are not the only assets being built in Texas. Last year, Dresser-Rand and Apex Compressed Air Energy Storage announced the first large compressed air energy storage project that the U.S. has seen in decades.

Finally, Texas’ Competitive Renewable Energy Zone transmission project was recently completed, which could bring up to 18 gigawatts of wind onto ERCOT’s grid. Currently, Texas has about 12 gigawatts of wind. If wind power increases by 50 percent, storage for energy needs and grid-balancing services will likely become even more acute in the Lone Star State.

Honorable Mention: States Within PJM

PJM Interconnection is the largest grid operator in the U.S., covering part or all of thirteen states and the District of Columbia. It boasts some of the most innovative market design to enable demand response and alternative assets within the ancillary services market. Any state within PJM that passes legislation that encourages energy storage (particularly those with relatively high energy prices) could quickly join the states mentioned as potentially attractive energy storage markets.

***

Download the free report brochure here.

Find out how utility, solar, and storage executives are handling opportunities and challenges at the grid edge. Learn more about GTM Research's Grid Edge Executive Council here.