During a visit from Chilean head of state Michelle Bachelet, President Obama pointed to an unlikely example of the strong ties binding the two countries together: solar power.

The president noted the shared interest the two countries have in transitioning to a clean energy economy, and Bachelet called the U.S. Chile’s “most important foreign investor.” The $230 million loan recently approved by Overseas Private Investment Corporation for First Solar’s 141-megawatt solar project in Chile certainly affirms both statements.

There is much more to this investment than the politics. Financing through OPIC is a savvy business move which has ensured that American companies will develop a leading presence in one of Latin America’s most exciting and lucrative markets.

The Chilean market opportunity

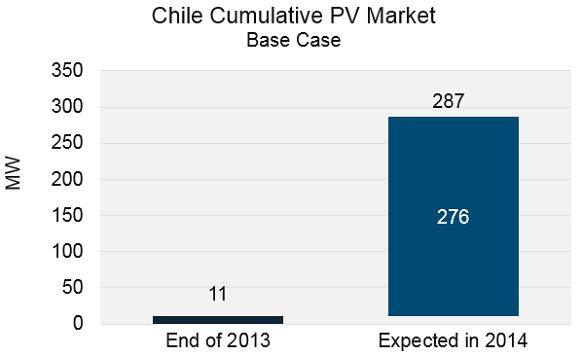

The Chilean solar market will grow to 287 megawatts this year, from a base of 11 megawatts in 2013. This is the most solar ever installed in any Latin American country, tripling the amount installed in Peru, the former regional leader. So why is Chile suddenly taking off?

Source: Latin America PV Playbook

Chile has a number of characteristics that are driving this rapid growth, including a need for new supply, high marginal power prices, strong insolation levels, a transparent power market, clear regulations, and a mandatory target for renewable generation. These factors are converging to create a highly attractive market. However, it has taken time for projects to materialize, as developers negotiate offtake agreements in a highly competitive atmosphere, educate market participants about solar technology, navigate the permitting process, structure projects to meet the lender’s risk profiles, and then complete construction (read more on what early developers have learned here). This is the new normal in sustainable markets, which will differ from the growth pattern seen in policy-driven markets.

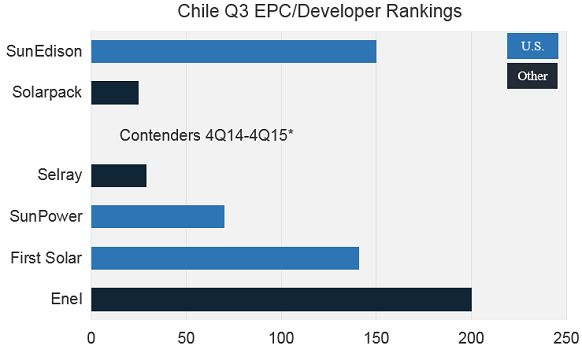

The U.S. tops both of GTM's downstream Chile rankings

In GTM Research’s Latin America PV Playbook, we currently rank two different downstream metrics. First, we look at which developers and EPC companies have the largest market share. Second, we break down which countries are investing the most in the market. The U.S. is currently dominating both categories.

In terms of company’s developing projects, SunEdison is currently the unquestioned market leader, with 150 megawatts in operation. Second place is currently held by Solarpack, a Spanish developer with 25 megawatts installed; however, by the end of the year, Solarpack will cede the No. 2 spot to SunPower, another U.S. company, which will soon be completing its 70-megawatt Salvador project. The recent OPIC decision to provide $230 million in financing for First Solar’s 141-megawatt Luz del Norte project ensures that, by this time next year, three of the top six developers in the country will be U.S. companies.

Source: Latin America PV Playbook

In the second category, the most active investor in Chile for debt financing is...you guessed it: the United States. OPIC has poured $629 million into five projects, totaling 431 megawatts. That is four times as much as the next largest investor, the International Finance Corporation with $130 million -- and larger than the next six investors combined, which boast $507 million in investment between them.**

Source: Latin America PV Playbook

These two factors are, of course, interrelated. U.S. companies are dominating the downstream market in no small part because of their access to capital. But one huge benefit of the U.S. strategy in Chile is that it isn’t just cashing in on a market opportunity -- instead, it is actually helping to create the market. Having companies and financiers which are willing to be first movers in sustainable markets is a big part of unlocking market growth and creating a bigger pie for everyone. Once a few developers gain experience in the market, players across the entire energy ecosystem -- offtakers, grid operators, policymakers, commercial lenders -- can become more comfortable with the solar value proposition. The risk of lending to the first solar project, signing the first PPA, or rubber-stamping the first environmental approval is much higher than in subsequent deals.

The influx of U.S. capital and experienced developers who can build trust have sparked what will be one of the largest regional markets over the next five years. Stay tuned for more detailed coverage from GTM Research on this topic.

***

Notes

*Based on project pipeline

**This also makes the (generous) assumption that the entirety of BBVA's $150 million credit line to Enel Green Power goes to its Chilean projects, although that fund was intended for Enel’s entire Latin America pipeline.

***

Adam James is a solar analyst with GTM Research covering global downstream markets, and the author of the Latin America PV Playbook. You can find him on Twitter at @adam_s_james.