In five years, the U.S. could be using a bit less coal to generate electrical power than it is now.

Power plant owners anticipate retiring almost 27 gigawatts of capacity from 175 coal-fired plants in the next five years, according to data compiled by EIA. That's 8.5 percent of the 1,387-generator coal-fired capacity in the U.S., driving 318 gigawatts. Another EIA bulletin has 49 gigawatts of coal retired by 2020.

To put that in perspective, the entire global solar photovoltaic industry will ship 30 to 35 gigawatts of solar panels in 2012.

EIA attributes plant closure to:

- Modest demand growth

- The favorable and steady price of natural gas during this current boom in shale gas

- Readiness of the combined-cycle plant fleet

- Aging coal-powered plants generators.

- Environmental compliance and RPS compliance

From the report:

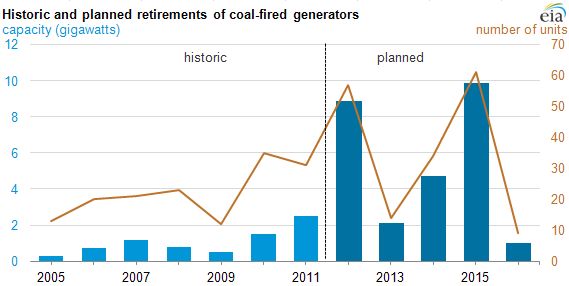

- The coal-fired capacity expected to be retired over the next five years is more than four times greater than retirements performed during the preceding five-year period (6.5 gigawatts). Moreover, based on EIA data, the approximate 9 gigawatts of coal-fired capacity retirements expected to occur in 2012 will likely be the largest one-year amount in the nation's history. The record is, however, expected to be short-lived, as almost 10 gigawatts of coal-fired capacity are expected to retire in 2015.

- Coal generators retired between 2009 and 2011 had an average size of 59 megawatts. By contrast, the average size of a coal-fired plant planned for retirement between 2012 and 2015 is 154 megawatts, more than twice the average size of the units retired during the 2009-2011 period. Twelve units of at least 200 megawatts are expected to retire in 2012, including two 790 megawatts units. Another 13 coal-fired units with generating capacities of 200 megawatts or greater are expected to retire in 2015.

- Plants planned for retirement are more efficient than previously-retired plants. By 2015, the retiring coal-fired units will have average tested heat rates of about 10,700 British thermal units per kilowatthour; these coal-fired units are approximately 12 percent more efficient than the group of units, on average, that retired during 2009 to 2011, but 5 percent less efficient than the average coal unit.

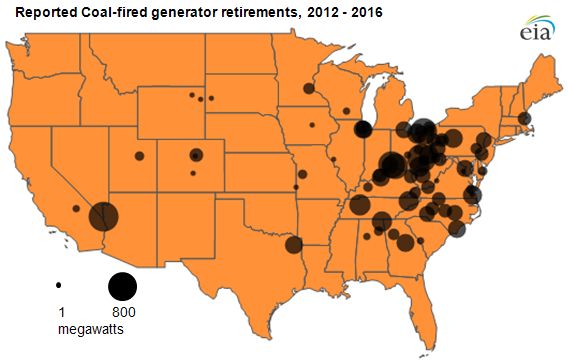

The concentration of closures in the eastern U.S. is striking.

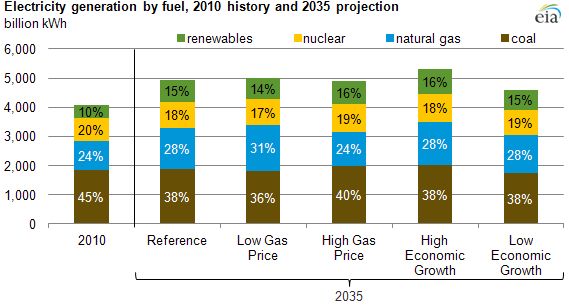

So what's going to take the place of all that coal? And what's EIA's take on the future of fuel over the next twenty years?

Well, it's not too dramatic, according to the EIA.

Coal drops a bit in terms of percentage, but stays steady in terms of kilowatts generated. So it's coal that actually takes the place of that retired coal.

Nuclear stays steady, natural gas goes up a bit, and renewables go up considerably from their current 10 percent, according to the report from the government agency (which has been wrong before).

Germany claims 25 percent renewables today, led by wind with 9 percent, according to BDEW, the country's energy industry association.

California's big investor-owned utilities reached 20 percent renewables last year. But other U.S. utilities will have trouble meeting those heights or achieving aggressive RPS targets if the data from EIA is correct.