Late last year, GTM Squared reached out to nearly 500 energy industry professionals to ask them 20 questions about the future of the electricity grid. This week, we’re making the fruits of that research available to Squared members, in the form of our first Annual Survey Report: The Future of Global Electricity Systems.

Our goal was to find out how technology vendors, private-sector service providers, public and investor-owned utilities, independent power producers, regulators and researchers view the key challenges and opportunities to come with the emergence of distributed energy resources on the power grid.

As one might expect, the survey revealed some significant disconnects between utilities and DER vendors on how that future should unfold -- or how prepared different players in this evolution are for the changes ahead. But we also saw a good deal of alignment between parties, as pointed out in our sneak peek into results on recent net-metering policy debates, for instance.

While the full 40-page report now available to Squared members goes into much greater detail, we’ve drawn out some of the high-level findings for our readers, focusing in particular on answers that reveal where utilities, regulators and private-sector players don’t see eye-to-eye.

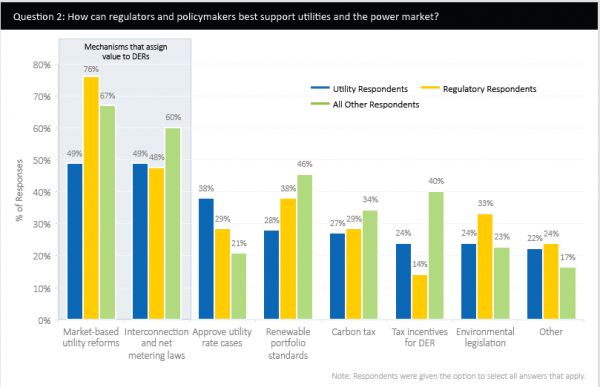

Take the different responses to questions asking participants to identify the greatest challenges electric utilities face today, and how well the industry is prepared for them. Perhaps unsurprisingly, 73 percent of utilities say that regulatory hurdles are their greatest challenge, and identify the development of market-based reforms, as well as clear interconnection and net-metering rules, as the key ways to address them.

But when asked whether the industry is prepared for how the growth of DERs will change their business models, utilities are far less confident than their private-sector brethren. Utilities are three times more likely to say that neither they nor the industry as a whole are prepared, compared to technology providers, project developers, project integrators and R&D respondents, which are most likely to say that they are prepared but the industry is not.

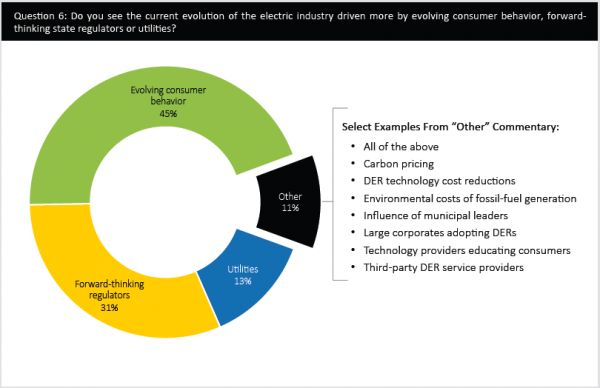

Another disconnect revealed in the survey has to do with the role that utility customers will play in this evolution. When asked to pick which major trend would drive electric-industry evolution, 45 percent of respondents picked evolving consumer behavior, a much higher ranking than "forward-thinking regulators" or "utilities."

But this focus on customer engagement wasn’t as strong in responses to how individual organizations are preparing for this evolution, compared to technology investment or regulatory involvement. And as GTM has been covering, utilities are still moving slowly to bring customers the data coming from smart meters and grid analytics.

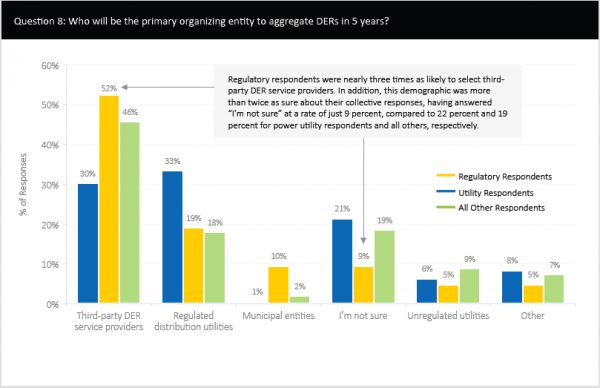

Another big disconnect the survey revealed is between utilities and their regulators on the issue of who will end up being the primary organizers of DERs over the next five years. Not surprisingly, utility respondents were most likely to identify themselves as that organizing entity. But regulators were nearly three times as likely to identify independent service providers as the key players -- indicating a potential conflict ahead in state-by-state efforts to open DERs to grid needs.

Other questions delved into specific technology classes, such as energy storage. Respondents agreed that storage would play the single biggest role in the solar market over the next five years, as well as that hardware and soft-cost reductions would be the driving factor enabling energy storage to grow. As for different battery technologies, lithium-ion was the clear favorite, with nearly half of respondents naming it the dominant technology in 2020, compared to a mere 17 percent for all other technologies combined.

Respondents were less united in their view of the role that microgrids will have on the power industry over the next 10 years. About one-third consigned microgrids to “niche applications,” while 23 percent agreed that they will “transform the business landscape to a large customer-centric model,” 21 percent identified them as important substation-level management tools, and 13 percent agreed that they will emerge as the “standard for organizing the distribution grid.”