There is $100 trillion looking for a good solar investment, according to NREL Senior Finance Analyst Michael Mendelsohn. The only obstacle is perceived risk.

Fund money -- pension funds, insurance funds, mutual funds, sovereign wealth funds, private equity funds, hedge funds, exchange traded funds (ETFs), and private wealth -- isn’t coming to solar and other renewable energies because “we need a tradable liquid product,” Mendelsohn said in an opening day session at Intersolar North America 2013 in San Francisco.

Risk is an obstacle for solar, explained New Oak Founder/CEO Ron D’Vari, because markets are characterized by “short memory and fear.”

Strategies for reducing perceived risk are proliferating. TruSolar’s industry-wide undertaking aims to include every possible risk input, currently numbering over 400 factors, into a score that qualifies and prices a solar project’s risk in every dimension of the value chain.

Indicative of the way solar finance is changing, a survey by truSolar of project originators with over 2 gigawatts' worth of cumulative installed capacity and 5 gigawatts of pipeline capacity found that 80 percent do not expect current tax equity leaders will be tomorrow’s solar finance leaders.

Less ambitious efforts to quantify and characterize risk are the Mercatus software platform and Wiser Capital’s WASR rating system. Mercatus’ online application scores projects in eight categories to create a FICO-like score and opens up a digital deal room for project developers and investment bankers. Wiser Capital’s rating system quantifies risk for community banks looking to invest in community solar.

In a more traditional approach to risk, solar manufacturer and distributor aleo solar North America will offer one-call warranty resolution for its solar modules through solar project insurer Assurant. Aimed at residential rooftop solar-system owners, Assurant’s warranty management is intended to eliminate consumer concerns by providing a single point of contact for any warranty-related claim. Less consumer risk should, Assurant believes, translate into more solar adoption.

But that is just the beginning, Mendelsohn said. To transition away from the investment tax credit (ITC) and traditional equity finance, the solar industry needs to expand the availability of capital.

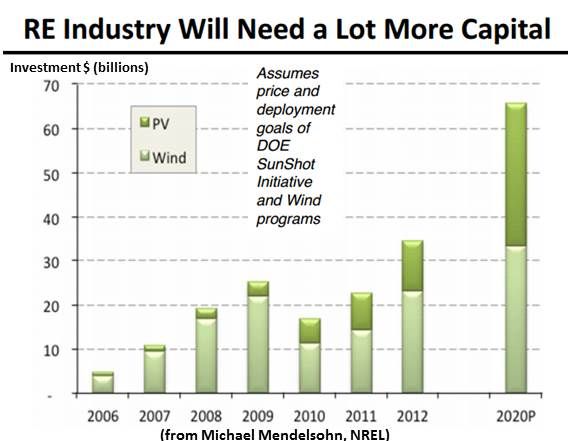

To sustain its growth, solar must double available capital by 2020. “The only way to get there is public markets,” Mendelsohn said. Vehicles will likely include master limited partnerships, real estate investment trusts (REITs), asset-backed securitization, credit enhancements like tax credits and loan guarantees, and first loss provisions like co-investment or public mezzanine investment.

Mendelsohn expressed ambivalence about the much-discussed REITs because qualifying for them might disqualify solar projects from eligibility for accelerated depreciation and the ITC, incentives that have won solar much traditional tax equity backing. Securitization, on the other hand, holds much promise, Mendelsohn said.

“Securitization is going to be a part of this business,” agreed Capital Fusion Partners CEO John Joshi, “but not a panacea. And I’m not a believer in first loss vehicles. That’s not the way to go. Fannie and Freddie are the perfect examples. If you don’t believe in your portfolio, I don’t want anything going to you.”

To qualify for the big money, Mendelsohn said, solar must standardize the documents associated with finance and build robust data sets that eliminate perceived risk.

The final product must be a tradable liquid asset that earns the approval of credit rating agencies.

Astonfield Renewables’s Osiyan Project earned just that kind of recognition from CRISIL, India’s version of a Standard & Poor’s-type credit rating agency. As announced at Intersolar, the 5-megawatt thin film installation was rated A- by CRISIL, the first A-level rating ever earned by a solar project and a landmark in the Jawaharlal Nehru National Solar Mission's (JNNSM) drive toward 20,000 megawatts of grid-connected solar by 2022.

The Astonfield project’s European-manufactured T-Cell modules, though no longer allowed under new local content requirements, have set a reliability standard for India’s emerging domestic PV manufacturers. The project’s 25-year power purchase agreement with NTPC Vidyut Vyapar Nigam, the JNNSM-approved national utility, promises secure long-term returns.

“The credit rating shows the project’s ability to pay back investors,” an Astonfield representative noted. “And India needs foreign investors.”