Grid parity. The phrase is impossible to escape. It's become the buzzword, the catchall phrase where PV is concerned. In solar-world, it is the equivalent of the Rapture or the Second Coming: The moment everyone is waiting for with bated breath, an historical inflection point past which solar will no longer require the crutches of subsidies and incentives to be competitive, when the "infinite" addressable market for solar will finally open up, and demand for photovoltaics will tear down the floodgates.

We are told that although solar has made considerable strides in its march towards this Mecca, we are not quite there yet. The magic number for modules, say they, is $1; at a buck a watt. At that point it will finally be cheaper to produce subsidy-free electricity from a module than buy it from the grid. Once you're convinced of this conventional wisdom, it's hard to see PV being cost-competitive right now or any time in the next few years. Roughly speaking, current module prices range from $2.50 to $4.00/W, so a $1/W module would take quite some doing.

At the risk of being at the receiving end of many a derisive "d'oh" from informed citizens for my perceived Captain Obviousness, there are so many problems with this train of thought that it's hard to know where to start. The notion that a single, round number will drive solar cost-competitiveness the world over is a considerably misleading, blatant one-size-fits-all oversimplification at its finest; moreover, the anointed choice for that number, in the event one must be named – $1/W – is just plain wrong. For those in the business to perpetuate either of these myths is neither intelligent nor responsible. The answer to the question "At what module price grid parity?" must necessarily be, surprise, surprise: It depends.

But doesn't it always depend? Of course it does. With all things in life there's a distribution, and policy makers, investors and readers don't have time to understand distributions, so you have to give them a representative number, a platonic ideal, a possibly fictitious average (and the nicer and rounder the number the better – what's more perfect than $1 in that regard?). While an average is certainly a useful representative of a distribution with a narrow spread/standard deviation, it's damn near worthless at telling you anything about a distribution with a wide spread. To steal an oft-quoted line from an old colleague, if I have one hand in boiling hot water and the other in ice, on average I feel fine. And solar most definitely is one of these widespread distributions – so it doesn't just depend, it really depends.

How does it depend exactly? This isn't rocket science, but it does beg some further explanation. Let's assume you're talking about residential or commercial-scale, distributed solar electricity here (as opposed to utility-scale solar, which is centralized). The metric for the "grid" that you're seeking parity with is then retail electricity rates, and you want to compare this to what's called the LCOE, or levelized cost of energy, for solar – essentially the present value of all the "cost flows" generated over the life of the PV system, divided by the total electrical energy generated by the system. Let's look at just a few prime movers of the grid parity equation:

- Retail Rates. Depending on which grid you want to be at parity with, your target cost could be anywhere between 5 cents per kilowatt-hour (for China and India) to a whopping 25c/kwh (Italy); in the U.S. alone, retail rates can vary by a factor of up to 5 times. For major demand centers with high retail electricity such as Italy, Spain, Holland, Great Britain and California, $1/W is about twice as low as you'd have to go.

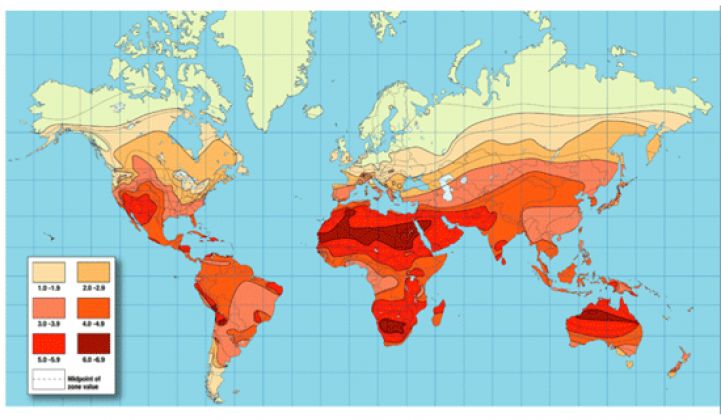

- Insolation. Incident solar radiation is directly proportional to how much bang you get for your solar buck, and Arizona, California, Spain and Sicily are roughly twice as fortunate as say, Germany in this regard. Again, variation across the U.S. alone is significant. As the images in slide one and two below suggest, with so much variation, averages really don't tell the story that well. In high insolation regions, $1/W is simply not representative.

- Financing. Financing costs constitute a significant portion of the LCOE – and loan terms, the cost of credit and leveraging ratios can make a telling difference to the bottom line. If you don't believe me, check out NREL's analysis on slide three below (also located here).

I could go on forever, but I think I've ranted on at sufficient length to communicate my message. Grid parity is not a singular event – PV's competiveness with the grid varies wildly based on the region in question, meaning that individual regional markets will open up over the next several years based on local parameters. The idea that module prices need to come down to $1/W for solar to be competitive is misplaced at best, and to a great degree, just plain wrong – it dangerously erases the important fact that even at current prices, PV is at or near parity with the grid in a number of markets. The revolution, kids, isn't coming. The revolution is now.