Government funding stole the show last week, with Abu Dhabi's Masdar Initiative announcing Thursday that it would spend $2 billion to buy three thin-film solar lines from Applied Materials (see Green Light post).

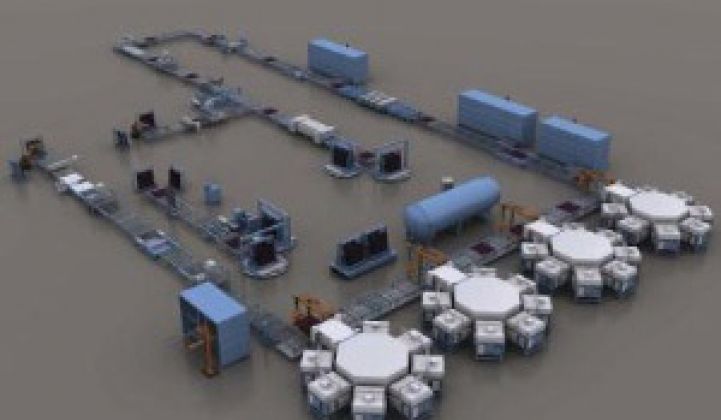

The SunFab lines manufacture amorphous-silicon films on 5.7-square-meter glass panels. One of the lines will be located in Erfurt, Germany and is expected to begin production in the second half of 2009, according to Applied Materials (NSDQ: AMAT). The other two will be located in Abu Dhabi and will start up in early 2010, the company said.

All together, the lines are expected to be able to produce up to 210 megawatts of solar energy.

The announcement is the latest in a series of orders for Applied Materials equipment.

According to preliminary numbers presented by Travis Bradford, president of the Prometheus Institute, before the Masdar news last week, customers had announced orders of an estimated 278 megawatts of capacity in 2008, 1.9 gigawatts of capacity in 2010 and 4.2 gigawatts of capacity in 2012.

For comparison, Bradford expects thin-film production to grow from 1 gigawatt this year to more than 9 gigawatts in 2012 (see Thin-Film Solar Has Bright Future).

But while customers are ordering many systems from Applied Materials, Bradford said the efficiency of the films the company's equipment will produce is still in question.

Bradford forecast amorphous-silicon technology will stumble slightly in 2008 and 2009 as bugs are worked out, then take off in 2010 based on the vast number of orders for the equipment.

The United Arab Emirates isn't dispensing all the government money, of course. The U.S. Department of Energy said Tuesday that it plans to invest up to $130 million to develop hydrogen fuel-cell technology in the next three years. The cash will go to up to 50 projects and will pay for between 50 and 80 percent of the projects, the D.O.E. said.

There also are indications the industry could be less dependent on government funding soon.

According to The Wall Street Journal, bankers and investors say they expect initial public offerings for clean-energy companies to pick up soon. Earlier this month, PricewaterhouseCoopers and the National Venture Capital Association also predicted more IPOs and acquisitions starting next year (see Greentech Exits Ahead?).

In the meantime, here are some of the notable fundings from last week:

PRIVATE:

Solar:

- Sopogy, a Hawaiian company that wants to put solar-thermal troughs on rooftops, scored $9.1 million, Earth2Tech reported Friday. Investors included Ohana Holdings, Bethel Tech Holdings, Energy Industries Holdings, Kolohala Holdings, Black River Asset Management and Tetris video-game entrepreneur Henk Rogers. The Honolulu-based startup also got backing from the state of Hawaii, which signed a bill last month for issuing $35 million in bonds to support Sopogy. VentureBeat earlier this month reported the company had closed a then-undisclosed amount and was eyeing an IPO.

Biofuels:

- San Diego-based Sapphire Energy has raised more than $50 million and has access to plenty more, according to VentureBeat. The 1-year-old company said it has developed an alga that produces a bio-based crude oil that can be processed by existing refineries. Competitor LiveFuels also has been working to develop algae that can produce biocrude, but algae has so far proven difficult to grow cheaply in large quantities. VentureBeat reported Thursday that Sapphire investors Arch Venture Partners, Venrock and The Wellcome Trust have given the company an "open checkbook" to draw as much capital as necessary to rapidly commercialize the technology

- EdeniQ, which develops cellulosic-ethanol technology, raised $33.12 million in venture capital from Advanced Equities Investments, Draper Fisher Jurvetson, Element Partners, Angeleno Group, The Westly Group, Omninet, DAG Ventures and Northgate Capital. Private Equity Hub reported that the company will use the money to complete its spinoff from Los Angeles-headquartered AltraBiofuels, which focuses on producing corn-based ethanol. AltraBiofuels said last month that it had become EdeniQ's largest shareholder by keeping 30 percent of EdeniQ's outstanding equity. EdeniQ, based in Visalia, Calif., works on turning agricultural waste such as woodchips and rice straw into fuels.

PUBLIC:

Solar:

- Swiss firm EnergyMixx is forking over £2.93 million ($5.78 million) worth of its shares to Low Carbon Accelerator in exchange for the London-based investment firm's entire holdings in HelioDyanamics. HelioDynamics, based in Cambridge, England, makes a concentrating-solar system and can now count EnergyMixx as one of its main customers. EnergyMixx agreed to pay £960,000 ($1.9 million) later this year and £870,000 ($1.72 million) by next April if HelioDynamics meets certain milestones.

Biofuels:

- Pacific Ethanol, based in Sacramento, Calif., raised $28.5 million by offering a combination of common stock and warrants. The company sold 6 million units, with each unit consisting of one share of common stock and one warrant to purchase 0.5 share of common stock. Each unit cost $4.75. Warrant holders can exercise their holdings six months from the close of the financing at $7.10 per share. The company, which had to cancel manufacturing plans because of a low market demand for ethanol, said earlier this month that it had planed to raise $34.3 million.

Other:

- Western Wind Energy Corp. on Thursday announced it is raising $18 million from a share offering by a syndicate led by Loewen, Ondaayje, McCutcheon. The wind-energy producer is traded on the Toronto Venture Exchange under the ticker "WND."

- SulphCo, which sells equipment that uses high-frequency sound waves to change the molecular structure of crude oil, raised $5.1 million by issuing 1.9 million warrants as part of a 2007 agreement between Houston-based SulphCo and warrant holders. The new warrants have an exercise price of $7 per share for a three-year term. The company also announced it has agreed to sell an additional $22.1 million by selling 6.9 million shares of its common stock at $3.20 per share.