A decade ago, BC Hydro, the utility serving nearly 2 million people across the vast province of British Columbia, put together its first business case for smart meters.

The goal: stop marijuana growers from stealing electricity and putting equipment at risk.

Weed farmers weren’t the only ones illegally diverting power from BC Hydro’s lines. But they were the biggest offenders by far, accounting for the majority of the estimated $100 million in yearly revenue losses from theft in the utility’s territory.

In 2005, BC Hydro piloted distribution system meters and analytics software to compare primary-voltage levels with local electricity consumption. The utility has since uncovered 2,600 instances of electricity theft and saved millions of dollars.

That theft detection pilot -- along with experimentation with residential smart meters and time-of-use rates a year later -- encouraged BC Hydro to ramp up its grid modernization efforts and install the most robust advanced metering infrastructure possible. Hunting down weed-growing electricity thieves was only one benefit; the utility’s 2011 business case also included outage management, voltage optimization and increased customer control.

At a time when many utilities were mostly thinking about using meters to improve the billing process, BC Hydro sold its 2-million-unit smart meter program to regulators as a way to boost grid performance in a variety of ways.

Photo Credit: BC Hydro. A fire caused by electricity theft.

The utility expects that electricity demand will rise by 1.7 percent every year for the next two decades, increasing overall demand by between 30 percent and 40 percent by the mid-2030s. Finding ways to control peaks and make the best use of existing distribution equipment was crucial to the advanced meter rollout.

“The last thing we wanted was simple meter-to-cash,” said David DeYagher, BC Hydro’s senior manager of field device operations, referring to using the meters for billing improvements. “We wanted to be meter-to-grid.”

The distinction was not just a semantic one. In practice, it meant putting together a comprehensive business case for the meters and selecting technology providers that could help deliver a multi-service network. In 2011, after much speculation about which companies would provide the millions of meters and the networking, BC Hydro announced that Itron and Cisco had won the contract. (Note: Itron is a sponsor of this feature.)

Four years later, BC Hydro has installed 1.9 million smart meters and is transitioning the network to the newest Internet Protocol, IPv6, to allow other compliant vendors to plug into the network with ease.

Nearly all customers have transitioned into automated billing, and more than 90 percent of them have access to their detailed energy profiles online. But the benefits, says the utility, go well beyond those conventional applications.

Last fall, the company completed the complex and time-consuming process of integrating its outage management system with the new metering infrastructure, saving more than 2,000 truck rolls. The utility is also using the advanced meter data for voltage conservation and distribution automation through Itron’s software to analyze power quality.

“We’re bringing in power factor and voltage. We can detect wiring issues using the data. We were recently able to predict the blowout of a transformer. These are real benefits,” said DeYagher.

BC Hydro has also been experimenting with a distributed computing platform from Bit Stew to manage its meter network and enable “complex event processing” at the edge of the grid. DeYagher calls the peer-to-peer network “a manager of managers” that gives the utility a better view of the grid without over-investing in centralized IT infrastructure.

BC Hydro is far from the first to use its new meters in such a far-reaching way. The utility joins CenterPoint Energy, PG&E, SDG&E, Hydro One and a handful of others across North America as the leaders in building grid-edge roadmaps that extend well beyond meter-to-cash.

However, the gap between the utility leaders and those that are slower to adopt is wide. Technology companies are hoping to close that gap -- not necessarily by just selling more meters, but by selling more layered services at the edge of the grid.

Post-slowdown strategies: Distributed intelligence and the internet of things

The smart grid market is well into its second phase, defined by increasingly sophisticated applications and international expansion.

It is also defined by necessity -- both for utilities and for the technology providers themselves.

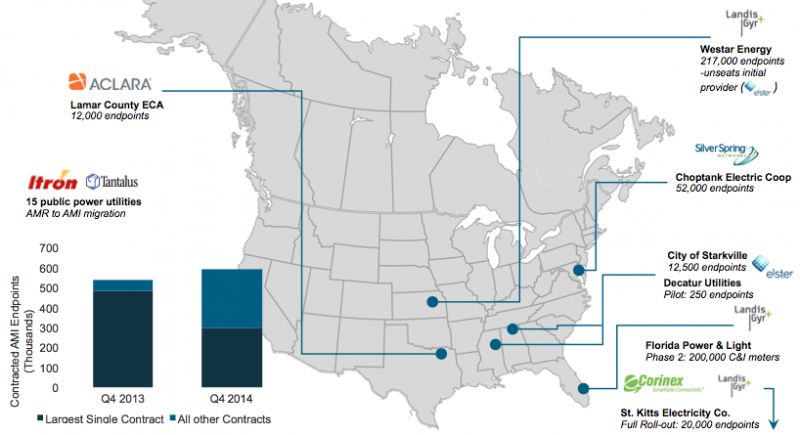

Long past the boom days of the stimulus that supported the installation of tens of millions of smart meters, vendors have seen orders in the U.S. slow to a comparative trickle. And with the largest North American rollouts fully complete, regional orders were coming in by the tens of thousands at the end of 2014, not the millions.

“It was an unrealistic expectation” that the market would continue growing at a steady pace once stimulus dollars ran out, said Ben Kellison, GTM’s director of grid research.

Meanwhile, utilities are facing hard realities. Revenue erosion from distributed generation, aging distribution equipment and efficiency mandates are all forcing power companies to find creative ways to deploy smart meters, or utilize their existing advanced meter infrastructure.

These challenges, while nerve-racking to utilities, present vast new market potential for vendors.

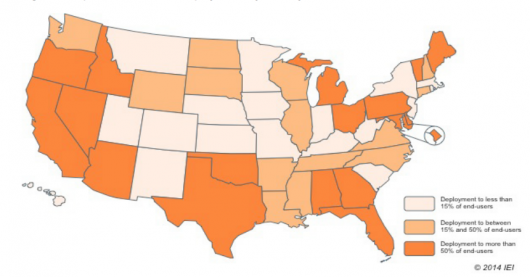

Photo Credit: Edison Electric Institute. Smart meter penetration in the U.S.

“There’s a pull from utilities looking to leverage their meters and extract as much value as possible, moving into outage management and providing better information to consumers. Now the smart meter manufacturers are looking to fill the need,” said Adam Cooper, a senior manager of research at the Edison Foundation’s Institute for Electric Innovation.

In its yearly report on smart meter deployments, the Edison Foundation outlines three areas that are driving innovation beyond meter-to-cash applications: integrating advanced metering infrastructure with outage management systems; integrating new distributed energy resources and electric vehicles; and enabling residential demand response and time-of-use programs.

Tim Wolf, Itron’s marketing director for smart grid solutions, said there’s been an expansion in what utilities around the world are looking for -- and thus in what companies like Itron have gravitated toward. That includes analytics, distributed computing in the field, and distribution automation.

He called it an “outcome-based approach” to advanced meter deployment.

“We’re really thinking about how all these devices are going to interact on the edge of the grid,” said Wolf. “We’re moving from a meter-to-cash focus, to analytics, to device interoperability, smart cities and the internet of things.”

Image: U.S. smart meter deployments are getting smaller. Source: GTM Research

Last October, Itron debuted its distributed intelligence platform, called Itron Riva, which connects meters and grid devices, analytic software, and Cisco’s communications and computing technologies on a unified software platform to crunch data and automate decision-making out in the field. It also includes new communications technology that combines RF and PLC on the same chipset.

The technology was field-tested last year in Hong Kong, at CLP Power. Itron also won a coveted contract with Duke Energy last spring for up to 4 million endpoints. Duke Energy has been utilizing the Itron-Cisco technology platform to test and validate distributed intelligence use cases, including voltage optimization.

“We’re starting to see a more distributed model, evolving from where utilities are collecting data in-house and putting a burden on network resources,” said Wolf. “The next step will be to move more data analysis and action to the edge of the network, as opposed to bringing that data back for analysis and then acting on it.”

Although still in the early stages, this type of “edge intelligence” is another step toward networking all kinds of disparate devices beyond the grid, including streetlights, thermostats, water heaters and air conditioners. In a recent call with investors, Itron CEO Philip Mezey said he was hoping software and networking would amount to $500 million in business “over time.”

Silver Spring Networks has also been at the forefront of distributed intelligence, both on and off the grid.

In January of last year, Silver Spring announced the SilverLink Sensor Network, which combines wireless sensors, smart meters and its cloud analytics service to give utilities the ability to process data out on the grid faster. Silver Spring says it will allow third-party equipment and analytics vendors to connect as well. Two U.S. utilities, Oklahoma Gas & Electric and Pacific Gas & Electric, were the first adopters, and the company says it's signing on more customers.

A year after debuting SilverLink, Silver Spring unveiled a tiny battery-powered wireless connection device designed to network both distribution equipment on the grid and devices in the urban environment outside the grid.

“As you get into smart cities and the internet of things, there are [many] devices we can go into,” said Don Reeves, Silver Spring’s executive VP of engineering, speaking to GTM.

Beyond-the-meter strategies appear to be bringing results. With more projects emerging on the smart cities front, along with strong sales of higher-margin software products, Silver Spring expects to break even next year.

{sponsor}

This strategy also guides Landis + Gyr, which has scooped up a number of large contracts after getting acquired by Toshiba in 2011. Its biggest win was in Japan, where it is providing the networking, communications and meter data management system for a 27-million-unit smart meter rollout in TEPCO territory in Tokyo.

Last June, Landis acquired the software company GRIDiant, marking yet another major analytics announcement from a smart meter company. The software processes massive quantities of data collected from sensors, meters, SCADA systems or even networking platforms from competitors, and creates real-time models of how the grid is performing.

The company is pushing the software as a way to help utilities manage batteries, solar systems and other distributed systems. Landis also uses its Gridstream meter data management software to monitor power quality, a system which it recently deployed for Colorado Springs Utilities to help shed load and avoid installation of new distribution equipment.

“There are only so many meters, and a large percentage of those have been converted. We have to look for other growth potential and get additional value out of the systems,” said Gary High, senior vice president of sales at Landis + Gyr.

These new products are a logical progression for smart meter companies. The deployment of meters has created an unprecedented stream of data for utilities, which often aren’t equipped internally to process it. Armed with new computing platforms and software -- both developed in-house or picked up through acquisition -- leading meter vendors are trying to convince utilities they can take on the next phase of the smart grid.

“Will it bump revenue like the stimulus did? That’s unclear,” said GTM Research’s Kellison. “It’s all in how deep the utility market swings.”

International expansion: Moving beyond North America

Along with diversifying products, leading vendors are trying to diversify their markets. Success so far has been limited, but companies are picking up new contracts for meter deployments, meter data management, theft detection, and more sophisticated distributed intelligence projects.

Itron, which grew by serving the North American market, has dozens of projects in the U.S. and Canada featuring tens of thousands or millions of meters. It has only begun tapping Europe, Latin America and Asia.

The company has now completed nine international deployments of its OpenWay networking platform. In the last year, it has announced projects in Brazil and Hong Kong. However, aside from the project in Austria and securing a sizable portion of the Linky smart metering project with EDF, the company has largely been unable to lock up big deals in the fragmented European market.

Each region has different characteristics, said Wolf. Latin American countries, led by Brazil, are interested in deploying smart meters first. And countries in the Asia-Pacific region are more comprehensively focused on standards and a unified smart grid vision -- hence the OpenWay deal with CLP Power in Hong Kong and the opportunity to test Itron Riva in a tough field environment.

“In Asia, we’re focused on creating value out of the data and understanding what other devices can ride on top of the network to realize a broader smart grid vision,” said Wolf.

Although the end goal is different in every market, many international utilities are investing in smart meters for theft detection, particularly South America and Southeast Asia where electricity theft is rampant. Meter vendors hope to add more services over time, as happened eventually in BC Hydro's territory.

Photo Credit: Konstantnin via Flickr. Theft is a strong driver of smart meters internationally.

Both Silver Spring Networks and Landis + Gyr are also vying for a piece of the growing international market in an attempt to expand beyond the U.S. and Canada.

Silver Spring has secured a handful of sizable metering and networking projects in Australia, Brazil, New Zealand and Singapore, while also piloting smart streetlight projects to Denmark and France.

Landis’ deal with TEPCO in Tokyo was its biggest win outside North America. The company has also seen much more traction in Europe, where it locked up a contract for nearly 16 million smart meters in the U.K. And last year, Landis secured a major win for to deploy meter data management software for over 1 million endpoints in Brazil.

“We need to make sure that we’re able to grow internationally and go around the globe,” said High. “We have to be engaged in these markets.”

However, for all of these companies, international projects have not come as fast and furious as they did in previous years. As GTM Research’s Grid Edge Deployment Tracker shows, leading vendors have signed the vast majority of their contracts in the U.S. and Canada over the years -- and newer projects have not tipped the scales.

Although large meter contracts have slowed down in the region, North America is still important for leading vendors as they try to secure smaller municipal utilities and co-ops as customers, and build new services for large utilities with infrastructure already in place.

As utilities start to envision the next phase of the smart grid, the meters will play a secondary role -- supplanted by the services layered on top.

At least, that’s what the meter companies are betting.

“North America is still a very big part of the business, and resilient for what is considered a mature market,” said Wolf. “We see services and software growing as a bigger portion of the business.”