Investors didn’t show much love for Portuguese renewable energy firm EDP Renovaveis on Wednesday, sending shares down 4.37 percent on the wind-power company’s first day on the Euronex Lisbon exchange.

The stock (Lisbon: EDPR) debuted at €8 (about $12.36) and traded as high as €8.06 ($12.45) per share before closing at €7.65 ($11.82) per share. The lackluster performance reflects the overall weakness of the global equity market and dissatisfaction by some investors who thought the share price was too high, analysts said.

“It was weak on its entry into the market because the market conditions are not very favorable.” said John Dos Santos, a trader with Lisbon Brokers. “Investors who came in were hoping for a bit of an upward trend, but then they started to sell out.”

Other European wind companies also saw their share prices drop Wednesday. Shares of Spanish firm Iberdrola Renovables (Madrid: IBR) dipped 3.2 percent to reach €4.53 (about $7) per share. EDF Energies Nouvelles (Paris: EEN) also saw its stock decline by 1.85 percent to close at €45.54 ($70.35) per share.

Although the skyrocketing oil prices should make renewable-energy stocks appear attractive, investors also view cleantech as risky. Wind farms cost more to build and operate than solar-power systems, for example, which consumers can set up on the rooftops of their homes.

“Renewables are viewed as expensive, and EDP Renovaveis’s share price was viewed as expensive,” Dos Santos said. “In terms of sectors, solar energy has been more well received than wind energy.”

EDP Renovaveis primarily builds and operates wind-energy plants in Europe and the United States. Earlier this week, the company said it had raised €1.57 billion ($2.4 billion) through an initial public offering of €8 per share. The company sold 225.43 million shares, which represent 25 percent of the company’s value.

The IPO highlights the global ambition and growing power of the European renewable-energy firms (see Green Light post). Iberdrola Renovables raised €4.1 billion ($6 billion) last December. EDF Energies Nouvelles, part of Electricite de France, went public in 2006 after raising €525 million ($811.34 million at today’s conversion rate).

EDP Renovaveis has its own grand plan for the new money. It’s set on expanding the installed capacity of its power plants worldwide to 10.5 gigawatts by 2012 from 3.7 gigawatts today. It owns and operates wind-power plants in Spain, Portugal, France and the United States. It also has wind projects under development in Belgium, Poland and Brazil.

EDP Renovaveis is part of EDP Group, which generates and distributes electricity and natural gas in Europe and the United States. The EDP Group is the majority owner of HC Energía, the fourth-largest electric utility in Spain.

The new public company also owns Nuevas Energias de Occide nte (NEO) in Spain and Horizon Wind Energy in the United States. The renewable-energy company is the world’s fourth-largest wind-power developer. In October, it signed a $570 million agreement with GE Energy to buy 500 megwatts of wind turbines.

EDP bought Houston-based Horizon Wind from the Goldman Sachs Group last July in an effort to expand its presence in North America. As of September 2007, Horizon operated wind farms with 941 megawatts of installed capacity, and had another set of 615-megawatt projects under construction.

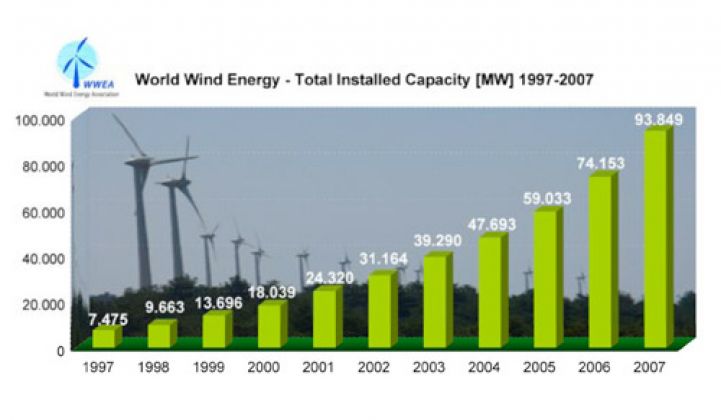

The global wind-energy capacity grew 26.6 percent to 93.85 gigawatts in 2007, according to the World Wind Energy Association (WWEA) in Germany. Wind-power plants are generating roughly 200 terawatt hours (2,000 gigawatt hours) per year, about 1.3 percent of the global electricity use. WWEA expects the capacity to grow to 170 gigawatts by 2010.